Beer, Wine & Spirits

While our site-wide selling guidelines still apply, there are additional requirements to sell in this category.

Seller requirements

- You must have a return delivery address in the local country or offer free delivery.

- You must be able to provide local language support for Customer Service in the store in which the products will be sold.

- You must not sell alcohol to buyers under the minimum drinking age governed under the applicable laws.

- You must provide acceptable documentation and any other information we request about the products you intend to sell, including information to demonstrate payment of excise duties in the local country.

- Your country of establishment must be within the UK to sell Beer, Wine & Spirits on Amazon.co.uk.

Product requirements

- The products you sell must be new.

-

Each product must have one of the following:

- A valid GTIN registered and associated with the product

- GTIN exemption

- Enrolment in the Brand Registry programme

- Alcohol by volume (ABV) values must be visible on all product pages.

- All food products, including alcohol, offered for sale on a European Amazon website must be intended for sale in the EU and comply with all applicable EU and local laws and regulations, including but not limited to food information and labelling regulations such as Regulation 1169/2011/EC.

- All food products, including alcohol, offered for sale on a European Amazon website must at least be labelled in the primary language of that website. For example, all food products offered for sale on Amazon.de must at least be labelled in German.

- All food products, including alcohol, offered for sale on Amazon.co.uk must at least be labelled in English.

Required attributes for alcoholic drinks

All alcoholic drinks must be offered in product type Wine, Beer or Spirits.

For beers, ciders and drinks with ABV less than 10%, set the attribute is_expiration_dated_product to True. If your ASIN has an expiry or durability date on the label, set the attribute product_expiration_type to Expiration date required.

For ciders produced by fermentation without a durability date, set the attribute product_expiration_type to Shelf life, and fc_shelf_life to 365 days.

For wines, spirits and sparkling drinks where ABV is equal to or greater than 10%, if your ASIN doesn’t have an expiry or durability on the label, set the attribute is_expiration_dated_product to False. Only set the attribute is_expiration_dated_product to True and product_expiration_type to Expiration date required if your ASIN has an expiry or durability date on the label.

Fulfilment centres that handle alcoholic drinks

If you are shipping alcoholic drinks to fulfilment centres, ensure that the following fulfilment centres for corresponding stores are provided in the system as destination:

| Amazon.de | Amazon.co.uk | Amazon.fr | Amazon.es | Amazon.it |

|---|---|---|---|---|

| FRA1 | BHX5 | XVA1, XFRZ and XOR2, XFRE | XMA3, XESF | XLI1, XITG |

If a different fulfilment centre is assigned, please submit a case to the Selling Partner Support team.

FBA requirements

You have to meet the following requirements when shipping alcohol products to fulfilment centres:

- Alcohol products cannot be shipped across borders via Fulfilment by Amazon. Products that are shipped to a fulfilment centre can only fulfil orders coming from customers with delivery addresses in the same country.

- Products classified as Spirits cannot be sold on Amazon.es.

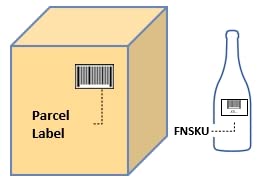

- You are responsible for sending the bundled units, ASINs composed of two or more units, either single- or multi-product, together in a suitable e-commerce box with the FNSKU sticker for the bundle ASIN on the outer packaging. For more details, go to Product packaging requirements. Preparation services do not include picking and assembling bundles.

- When shipments are delivered to fulfilment centres in Spain, France and Italy, all bottles must be properly prepared. All bottles must be packaged in a box approved for e-commerce. If bottles are sold as a bundle, which are boxes with two or more units, they must be packaged in a box with dividers approved for e-commerce. You have to prevent products from being damaged during transportation or storage. Below are examples of single and bundled ASINs that are allowed to be shipped to fulfilment centres:

-

Single product

Offer type: ASIN

Shipment type: A box that is approved for e-commerce can contain either same bottles or different bottles sold as individual ASINs.

Labels: Box: only parcel label; Bottle: FNSKU label on every bottle required

-

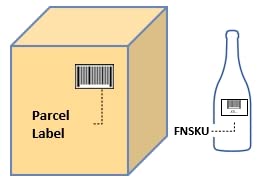

Bundle of same product

Offer type: Bundled ASIN

Shipment type: A box that is approved for e-commerce can only contain the bottles of the bundled ASIN. All bottles are the same and sold in bundle.

Labels: Box: parcel label + FNSKU label; Bottle: FNSKU label not required

-

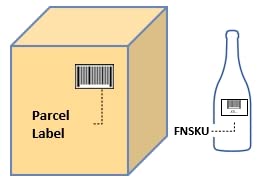

Bundle of different products

Offer type: Bundled ASIN

Shipment type: A box that is approved for e-commerce can only contain the bottles of the bundled ASIN. Bottles are different and sold in bundle.

Labels: Box: parcel label + FNSKU label; Bottle: FNSKU label not required

The examples above about Wine apply for Beer and Spirits, too.

Special preparation of shipments that contain Beer, Wine & Spirits products

Beer, Wine & Spirits products are handled by Amazon at special fulfilment centres.

The following special preparation requirements apply only to Beer, Wine & Spirits products in glass bottles. For more information on preparation requirements for all other glass, ceramic and breakable units, go to Packaging glass ceramic breakable and fragile units.

- Bottles don’t have to be individually boxed. If bottles are received prepared, they will be repackaged and prepared at the fulfilment centre if they do not meet carrier requirements.

- Units must arrive at the fulfilment centre in a box that is approved for e-commerce. We do not handle product prepping and recommend bottles be shipped on pallets or with another method that ensures individual units will not break during transport to the fulfilment centre, in accordance with FBA Shipping and routing requirements.

- Each unit must be labelled with the FNSKU linked to the country-specific SKU, for example, for Italy: FNSKU X000000000/MSKU IT-FBA-SKU1. The FNSKU label must cover the manufacturer’s barcode but not any other product information on the packaging.

- If bottles are to be sent in boxes, we require them to be closed and include only units of the same FNSKU.

- With regard to bundles of both same and different products, you are responsible for sending the bundled units together in a suitable e-commerce box with the FNSKU sticker for the bundle ASIN on the outer packaging. For more information, go to Product packaging requirements. Preparation services do not include picking and assembling bundles.

Excise duty requirements

Excise duty is chargeable in addition to any customs duty on certain goods, including alcohol. The requirements and level of duty payable differ depending on the country the duty is payable in. For alcoholic drinks, excise duty is payable in the country of consumption.

It is your responsibility to ensure that all applicable excise duties are paid on products that you offer in the Beer, Wine & Spirits category in the local country, the country of consumption. This may require registration with the local tax authorities or a duty agent.

For more information on the payment of excise duties in the EU, go to Excise duties.

For more information on the payment of excise duties in the UK, go to UK Trade Tariff: excise duties, reliefs, drawbacks and allowances on or before 31 July 2023.

Document requirements

| Country of establishment | Local | Non-local |

|---|---|---|

| Amazon.de | None | None |

| Amazon.co.uk |

|

Amazon.co.uk does not permit listings for Beer, Wine & Spirits products if your country of establishment is outside the UK |

| Amazon.fr | Excise number | French excise duty number of your bonded warehouse or fiscal representative in France, together with a declaration that states that you mandated such bonded warehouse keeper or fiscal representative to fulfil any obligation regarding excise duties on your behalf |

| Amazon.es | None | None |

| Amazon.it |

Standard requirement:

Requirement only for small-sized Italian wine producers:

|

|

Alcohol By Volume (ABV) listing requirements

To sell ASINs that have >0.5% ABV, you must possess licences to sell alcohol before selling them on Amazon. The licences should permit you to sell alcohol to customers from UK premises. These ASINs are to be listed under the Beer, Wine & Spirits category. During the listing creation process, you will be asked to upload your licence certificates in order to unlock your selling privilege in this category.

To sell ASINs that have ≤0.5% ABV, you may be exempted by the Licensing Act 2003 from possessing licences to sell alcohol to customers from UK premises. In this case, list these ASINs under the Grocery category. You must clearly state the ABV percentage on the product title and in the product attribution (alcohol content) for every ASIN.Next steps

If you meet all of the requirements listed above, click Request approval below. By clicking, you are confirming that you have reviewed the requirements above and that you want to apply to sell in the Beer, Wine & Spirits category. We will contact you to request any additional required information once you’ve submitted your request to sell.

Once approved, you may begin listing your products by clicking Catalogue and then Add products.

Brexit: UK Government guidance

The UK Government released guidance on selling food and drink products first made available in the UK after December 31, 2020. We encourage you to review this guidance, alongside any other specific UK Government guidance that applies to your product. Consult your legal counsel if you have questions about how the laws and regulations apply to your products starting January 1, 2021.