Sort by

Filters

Results for "69카톡판매⊱[ㅌㄹɪsᴇᴜʟᴛᴀʟᴋ⸥ pc카톡인증업체╢화력계정≳모바일카톡구매⟱카톡업체⋏"

(283 results)What is a good PC program for filing UK HMRC taxes? I've been doing it manually on the HMRC website, but they suggested using a computer application. Any recommendations?

Hello Let me explain the whole story in a few words.

Starting on 10 April 2024

Amazon indicate to us we need to pay GBP 47,258.28 VAT starting from 2021.

You can continue to sell, but your Amazon sales proceeds will remain temporarily ineligible for disbursement from this account, and any related accounts, until any UK VAT owed is paid to Amazon.

The company behind this account was established in August 2023, so it is impossible to have VAT from 2021.

According to the notification you (AMAZON) indicated to me, you also have to pay GBP 47,258.28 VAT ... THIS THING IS NOT POSSIBLE because we have not even generated sales of this amount, so we should have so much VAT to pay, which is wrong.

The company was founded in August 2023, so it is impossible to have VAT from 2021 to pay.

Until September 2023, the Amazon account belonged to a UK-based company whose owner was a UK resident for whom Amazon collected VAT.

After many many emails with drtax-vatliabilitysupport@amazon.co.uk we send all the document requested like: id, passports, driving licence, contracts, bills, banck statments, invoice .... etc.

Since April and until now, no concrete answer, every time I send an email or open a case, the same answer is returned to me:

//////

Hello from Amazon Selling Partner Support,

My name is Guillaume and I am contacting you regarding your VAT liability request. Thank you for your patience in this case. I understand how important this is for you and I am glad to assist you the best possible way.

Please let me inform you that our internal teams are working actively on your case. There is no action required from your side and I will keep you updated about the process.

Thanks again for your patience. We remain available.

Have a nice day !

//////

Hello from Amazon Selling Partner Support,

We understand how important is this matter for you. In response to your inquiry regarding the VAT applied to your invoices, we would like to inform you of the following:

The corresponding department is still working on your case and we will get back to you as soon as we have further information to provide.

We appreciate your patience and it was a pleasure to assist you.

Thank you for selling with Amazon.

///////////

on 19 June:

Hello from Amazon Selling Partner Support,

Thank you for your patience. At the moment, I am working with our internal team to reach a resolution on your case. While I don’t currently have an update, I will follow up with you as soon as additional information is available.

Thank you for selling with Amazon.

Sara B.

//////

3 months have already passed and nothing.

Does anyone know how soon the verification will be completed?

Can anyone help me speed up the verification process?

Very bad impact on store sales near to zero for 3 months.

Thank you

any help is highly appreciated @Seller_DNQGSsdC7DccM @Seller_gAhPNiLrkfTcr @Seller_yk3kzHpjMMa4B @Seller_VJ4XoAkjDpjPH @Seller_Huz6FT08OxHAR @Seller_fgtTzyHQfOM1x @Seller_TSXM2A5nxWSuH

Does anybody have any experience of using a PO Box address on Amazon, especially for returns?

We have been on Amazon for over 10 years, so not a new seller. We are moving from our business premises in a few weeks and will be using a residential address for a period. We do not want our residential address publically available for security reasons and have set up a PO Box address. This is no issue on any other marketplace or our website, but Amazon seem to be less than helpful with these type of changes.

All other business information will remain the same - company name, registered business address, company number, VAT number, contact details etc

- The return address will need to be changed to the PO Box address so that customers do not have our residential address.

- The ship from address can remain as our residential address if this information is not publically accessible and used only internally by Amazon. If it is shown publically then this would also need to be changed to the PO Box address.

Does anybody else do something similar or have any experience of it?

Thanks in advance

@Seller_gAhPNiLrkfTcr

@Seller_z3k8APxGfbQEK

@Seller_TSXM2A5nxWSuH

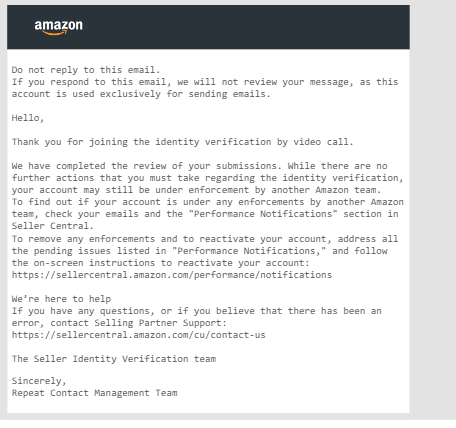

Hello. our account was deactivated on 11 april 2024 and funds were hold. upon enquiry with multiple teams on emails, we waited for 60 days. now today on 21 june 2024 we had our interview call done for identity verification. we received email after the interview as mentioned below. i would like to know when the funds will be released as the person only verified my passport and ask few basic questions only. it went smooth. and what enforced team they talking about? as my account deactivated due to recent VAT issue. i will resolve it with the team once the funds will be released as per amazon withhold policy.

@Seller_z3k8APxGfbQEK@Seller_hnDMgUKxMh1V4@Seller_Huz6FT08OxHAR@Seller_yk3kzHpjMMa4B your help will be appreciated if you could get this sorted asap and get my funds released please.

I am doing FBA and Amazon keeps the buy box with 6-7 months of shipping time on some of my listings. How on earth can it be possible? It cannot be accepted as a normal shipping time and there is no chance to beat those prices. Amazon does not allow us to win the buy box.

it depends on the product, if I have a product that sells relatively well, have few or no returns, doesn't require much packaging, I am happy with 15%/20%. I agree with you, it's important to focus on the bottom line, what other sellers do or how much you sell is not important. I am up 67% from last June and yet I sell less products.

Seller_soBD2wwhsVOww

Hi @Seller_z3k8APxGfbQEK,

Sorry for delay in answer and hope you had a good vcation :).

Unfortunately, started facing the same thing again.

Listing created as FBM with proper variation and approval thn converted into FBA and variation broken and listing tuned in to "Search Suppressed".

Did full file upload and started getting error 8040 again.

Batch ID: 341135019892.

Opened a case and I am sure that case will be closed with comment relationship not approved.

Case ID: 9897050182

Again, I dont understand why amazon first breaks the variation and thn rect variation under 8040.

What is the issue that causing variation break and no answer from amazon or seller support on the same.

Luckily I did wait before sending these units to FBA after converting them to FBA.

It implies that I shall not send new FBA ASINs to FC. This not only creates the delay in making unit available but literly block a seller to list and send new ASINs to FC. Causing significant loss to my small business and hope you can help me in this.

Thanks

Pranav

On the 6th March Amazon took delivery of a pallet from us but, after 100+ days, the shipment is still listed as "In Transit"

We've raised several support cases and provided every document requested, including the signed delivery note, but the response is always the same; "we’ve determined that this shipment is not yet eligible for reconciliation".

We're clearly stuck in a loop where Amazon won't investigate until 60 days after a shipment checks-in - but that'll never happen because they haven't checked it in.

We've spoken to several support representatives who have promised to investigate ... then we get another automated email telling us it's "not yet eligible for reconciliation".

Has anyone else managed to resolve a similar situation? - I feel we're just going round in circles now.

Any suggestions gratefully received

We have contacted the Amazon Health Account "Specialists" again. They keep telling us daily that our submitted information is being reviewed. This is ongoing for several weeks now.

We require someone from the Amazon Leadership Team to act upon our unlawful restriction on our funds.

BECAUSE

Based on the "EU VAT on e-Commerce (EU VOEC) Legislation – 2021" as it is stated on your webside page: https://sellercentral-europe.amazon.com/gc/vat-education/voec-establishment

{...From July 1, 2021, Amazon is responsible for collecting VAT on the following sales of goods delivered to customers in the EU where ordered through any Amazon storefront:

Goods delivered from inventory stored outside the EU with a shipment value of up to EUR 150; and

Goods delivered from inventory stored in the EU, irrespective of value, where you, the selling partner (sole trader or company/partnership), are not established in the EU for VAT...}

In our case, our company is based in Europe, in the Republic of Cyprus, as approved by Amazon on July 2023.

Our company sells ONLY via Amazon.de to Germany and Austria.

Therefore, the above-stated Legislation does NOT apply to us.

Amazon is actively undermining our business interests and infringing upon our EU company's rights to conduct commerce within the European Union by failing to accurately interpret and apply the EU VAT on e-Commerce (EU VOEC) Legislation of 2021.

Having issues with Group VAT registration - UK uses "Making Tax Digital" however Amazon wants a paper version, which HMRC no longer issues.

mdri-exec-escalations@amazon.co.uk haven't answered emails

MCF and removal orders, and funds now held.

Anyone got any advice? Or forum MODs, any chance you can contact us?

- © 1999–2024, Amazon.com, Inc. or its affiliates