Sort by

Filters

Results for "프라그마틱슬롯추천디시⸨ 텔 FT24CS ⸩에볼루션뜻-스윅스api-에볼루션바카라사이트-슬롯사이트제작-파싱사이트제작업체-카지노솔루션슬롯-트랜스알-바카라api업체-프라그마틱슬롯환수율"

(2137 results)As we know listings are being removed by the Amazon BOT every day, very often for no reason at all, however this is the best one yet, a computer mouse listed in, Keyboards, Mice & Input Devices >Mice

It is going to be removed unless it is moved to the SEEDS and PLANTS category, couldn't write the book! Come on Amazon, do better.

This is to inform you that the following detail pages are at the risk of removal from our catalog. You must take remedial actions before 7/1/2024, UTC, else your listing(s) will be removed from our catalog. It is your obligation to ensure that the products you offer, comply with all applicable laws, regulations, and Amazon's policies.

ASIN: B0795X2KWW, SKU: QP-B9B0-V294, Title: 5 Button USB Optical Scroll Mouse with Built in Calculator Key Pad

Why is this happening?

This product has been identified as a live plant or seed product that is listed outside of the SEEDS_AND_PLANTS or PLANT_SEED categories. Please update the product_type attribute to either SEEDS_AND_PLANTS or PLANT_SEED values as a path to reinstatement.

SICK AND TIRED OF AMAZON NONSENSE. If theres mods watching over the general mood of sellers in the UK, I don't think I'm alone in saying I've grown a deep dislike, distrust and outright disgust at Amazon.

Several Kups Dolcegusto listings removed for having Group Seb barcodes, despite the IP for Krups being owned by Group Seb. I've apparently got to provide a letter confirming a relationship between Krups and Dolce Gusto in order to fix the listings, despite Amazon selling multiple Krups Dolce Gusto machines and guess what, all Group Seb barcodes. NONSENSE!

I know that Amazon and the Tefal brand have a direct relationship and association, as Tefal sell their goods through Amazon themselves. So I set up a case to ask for some sort of proof, such as the letter of affiliation that Amazon expect me to be able to provide. Did I get one, of course I didnt, you already know this. So Amazon expect us to be able to get in touch with those in power within brands and get documents, but despite us having a direct line into Amazon themselves and they still wont provide the same sort of document either. NONSENSE!

Tonnes of squishmallows products listed as PS5 games, previous posts in here looked like I was getting help, any of them corrected? NOPE. NONSENSE!

4 IPs from the same brand for parallel. Invoice provided by the legitimate UK supplier, a brand everyone reading this will know and trust. Denied due to suspicions its been "edited". Ive since provided the entire chain of custody, bank statements, emails to the supplier asking for the invoice, emais from them with the file attached, and the original file and its filename. Has it been accepted for the legitimate non-parallel purchase made, NOPE. NONSENSE!

Amazon being investigated for monopolistic tactics and saying they "commit to treating third party sellers and Amazon retail equally regarding the buybox algorythm". I have a listing with only us and Amazon selling on it, its even co-mingled (and thats yet another problem where Amazon fall flat but too much to go into here.....). So basically, its the same stock, same service, same delivery expectations and the price, Amazon match ANY price I set instantly, so same price. Sells 100-200 a month. How many of those sales am I seeing? a tiny fraction...... I sent 60 units around december and still have nearly half.... And now Amazon will charge me late storage fees for the privalidge of not selling my stock to customers. NONSENSE!

If you're on a listing and can clearly show Amazon is not treating third party sellers equally, check your home page and make a complaint. The torrent of evidence backed complaints should either get them fined, or enact some sort of change.....

Hello,

I really need your urgent help/advice guys.

First of all, I'm not a new seller. I've been selling since September last year, I've achieved month on month steady growth on the UK marketplace. I currently have over 700+ active SKUs.

However, overnight, without any warning or notification, since 16 June, I have had a significant issue with my Amazon account: I have lost the BuyBox/Featured Offer for ALL of my listings.

As a result, in the last few days my daily sales have dropped from around £1000 to almost zero. In addition, my "Featured Offer %" has dropped to 0%. Btw, my account health is currently 248.

I opened several tickets without success, but chatted with Amazon Support who confirmed: "As of the moment your ACCOUNT is not eligible for BuyBox".

However, as to the reason why this happened and what I needed to do to get it resolved, I was told nothing but to wait. The problem is that I am losing money every day by not being able to sell anything, but I have to cover the costs of my business and order new products.

I cannot name here a specific ASIN, because this issue affects ALL of my SKUs (700+ listings), and given that it appears to be an Amazon-side problem. Therefore I am requesting your urgent assistance.

I have already emailed the Managing Director about this, but have not yet received a reply.

Can I somehow reach the team responsible to check my account and restore the Featured Offers in my account as soon as possible?

Thank you for your prompt attention to this urgent matter.

Thank you!

Regards

I'm getting nowhere with Seller Support (Live Chat & Phone), made a ticket asking for escalation, E-Mailed CEO's office and got a pretty rude reply, I'm at a total loss as to what to do. I have lost the buy box for ALL of my key products and best sellers, I am the brand owner, I am the only offer.

I am stunned at how little support there is from Amazon, I knew it was bad but I had no idea it was THIS BAD. Absolutely no transparency what-so-ever, nothing on performance notifications, account health is perfect, no violations, I am enrolled on the new Account Health Assurance scheme (which gave me peace of mind for all of 3 days).

With the CEO's office giving me the cold shoulder, seller support sending me links to 'Seller University', spending in excess of 10 hours trying almost everything on my account blindly, I'm at a complete loss sitting here with next to no sales. So my last resort is this... a mega thread... I'm hoping with enough people complaining about the issue, Amazon MAY acknowledge this problem as a bug/glitch before I have to file for bankruptcy (no exaggeration) and when they do, I also expect no apology or compensation.

Hi, Recently received this email (EMAIL 1):

⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄ EMAIL 1 ⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄

SUBJECT: Action Required - Your disbursements are at risk of being temporarily held

Hello,

The disbursements of part or all your Amazon sales proceeds are at risk of being temporarily withheld in all stores you operate worldwide (excluding Amazon.in), because we need to confirm whether you are established in the UK for Value Added Tax (VAT) purposes. Additionally, your Fulfilment by Amazon (FBA) inventory may be temporarily blocked from removal, unless the funds withheld exceed your estimated liability.

Why did this happen?

We must collect and remit VAT from non-UK established Selling Partners for the sales of goods delivered to customers in the UK. Based on a review of your account, we determined that you may not be UK established for VAT purposes. This may have resulted in inaccurate tax treatment on your sales under the VAT on eCommerce legislation (effective 1 January 2021 in UK). We leveraged a combination of automated means and expert human review to identify this issue and make this decision. We took this action in accordance with the Amazon Business Solution Agreement: https://sellercentral-europe.amazon.com/help/hub/reference/G201190440 and Amazon Payments UK Agreement: https://sellercentral-europe.amazon.com/help/hub/reference/GTVFVCWBJ6RJGKHM.

What actions do I need to take?

To avoid further impact to your disbursements, within 30 days of this notice, go to the Account Health page in your Seller Central account https://sellercentral-europe.amazon.com/performance/dashboard and follow the instructions from the banner you will find at the top of the page. Complete there one of the steps below based on your determination of business establishment.

If you meet the criteria for UK establishment: Submit the required documentation. We will complete our review of your submission within 3 days. If we verify that your business is established in the UK, your Amazon sales proceeds will be eligible for disbursement per your disbursement schedule within 24 hours. Additionally, if your Fulfilment by Amazon (FBA) inventory was held, it will be available for removal within 48 hours.

If you do not meet the UK establishment criteria: Verify that you are not established in the UK. In this case, you will not need to provide documentation, but you will need to address any unpaid VAT.

How do I resolve my unpaid VAT?

If you do not meet the establishment criteria, you will need to pay the VAT amount to Amazon for the historical unpaid VAT on all sales from 1 July 2021, which fall under the EU VAT on eCommerce legislation. In this case, we will send you additional information regarding next steps, including payment options, within one week of receiving your confirmation.

You can continue to sell, but your Amazon sales proceeds will remain temporarily ineligible for disbursement and any FBA inventory blocked from removal from this account, and any related accounts, until we can confirm your business establishment and the UK VAT owed is paid to Amazon.

We’re here to help.

For further information, go to the “UK VOEC: Determination of Establishment" page: https://sellercentral.amazon.co.uk/gc/vat-education/voec-uk-establishment

If you have additional questions, click the 'Contact Us' button on your Account Health page: https://sellercentral-europe.amazon.com/performance/dashboard to speak to an Account Health Specialist.

Sincerely,

Amazon Services Europe

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ EMAIL 1 ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

I am registered as a Limited Company but my threshold is under the £90,000 mark for the last 12 months.

So i sent in this submission and received this response:

⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄ RESPONSE 1 ⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄

Determining your Establishment:

I do not meet the establishment criteria.

✔️ I confirm that I do not meet UK establishment criteria for VAT purposes.

After this confirmation, Amazon will review my account’s sales activity and

advise if any VAT liability is due to Amazon for past transactions.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ RESPONSE 1 ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

I then received another email (EMAIL 2)

⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄ EMAIL 2 ⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄

SUBJECT: Potentially determination of non-UK establishment

Hello,

Thank you for your submission. Based on a review of your account and the information provided, we have concluded that your business is not established in the UK for Value Added Tax (VAT) purposes.

Why did this happen?

We must collect and remit VAT from non-UK established selling partners for the sales of goods delivered to customers in the UK. Based on a review of your account, we determined that you may not be UK established for VAT purposes.

This may have resulted in inaccurate tax treatment of your sales under the VAT on eCommerce legislation (effective 1 January 2021 in UK). We leveraged a combination of automated means and expert human review to identify this issue and make this decision. We took this action in accordance with the Amazon Business Solution Agreement:

https://sellercentral-europe.amazon.com/help/hub/reference/external/G201190440

and the APUK Agreement:

https://sellercentral-europe.amazon.com/help/hub/reference/G201190400

What actions do I need to take?

You will need to pay the VAT amount to Amazon for the historical unpaid VAT for the sales of goods delivered to customers in the UK on all sales from 1 January 2021, which fall under the UK VAT on eCommerce legislation. We will send you additional information regarding next steps, including payment options.

You can continue to sell, but your Amazon sales proceeds will remain temporarily ineligible for disbursement and any FBA inventory blocked from removal from this account, and any related accounts, until any UK VAT owed is paid to Amazon. Additionally, within 10 days we will begin to collect and remit VAT taxes on your future sales for goods delivered to UK customers.

Has there been an error?

If you wish to appeal this decision, reply to this email. You may be required to provide additional information and documents during an appeal process, which we will communicate to you via email.

We’re here to help

For more information, go to the "UK VOEC: Determination of Establishment":

https://sellercentral.amazon.co.uk/gc/vat-education/voec-uk-establishment

If you have additional questions and wish to speak to an Account Health specialist, go to "Contact Us" on your Account Health page:

https://sellercentral-europe.amazon.com/performance/dashboard?ref=ah_em_ap

Amazon Services Europe

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ EMAIL 2 ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

I got 4 options which were:

1. I would like more information as to how my VAT liability was calculated.

2. I disagree with how Amazon has calculated my VAT (not exactly written like this - i cannot view this page anymore)

3. I have paid VAT to HMRC directly (not exactly written like this - i cannot view this page anymore)

4. I have not yet received any VAT liability from Amazon.

5. Other (submit info) (not exactly written like this - i cannot view this page anymore)

My response first was to select 1 and i got this response (RESPONSE 2):

⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄ RESPONSE 2 ⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄

Which of the following is your enquiry related to?

I would like more information as to how my VAT liability was calculated.

Your VAT liability was calculated by assessing the sales you made to B2C

customers in the UK since January 1, 2021 for which VAT was not previously

collected by Amazon where it is payable under e-Commerce legislation.

Please note the following:

(1) Your VAT liability only includes sales of goods shipped within the EU to

B2C customers (i.e. non-VAT registered).

(2) The VAT rates applied are determined by Amazon according to EU law.

These may differ from any product tax codes you have set in Seller Central.

vat collected and paid via amazon for my account as i do not fall under vat

registrated company in uk

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ RESPONSE 2 ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Then i had the option to pick one of the 4 again and I selected option 4. This is the response i got (response 3):

⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄ RESPONSE 3 ⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄

Which of the following is your enquiry related to?

I have not yet received any VAT liability from Amazon.

✔️ Please note that it can take up to 7 days from determination of

non-establishment for Amazon to provide your preliminary VAT liability.

✔️ Confirm here that you have not yet received your VAT liability and are

waiting for Amazon to send.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ RESPONSE 3 ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Now I am waiting for a response. Is this okay?

Would this invoice I am going to receive be already be paid for as amazon has collected these fees since I have been selling?

Thank you & have a great day!

I am entering '0' but the whole thing is stupid, IMO.

If listing or editing used books, especially those that have been OOP for years, what is the point of supplying RRPs?

I guess they will use algorithms to average out RRPs from all sellers of a given ASIN but that won't make it any more meaningful

This now appears to be active across all of BMVD.

yes i listed 2 items as new

I'm seeing this on all used books when going into edit inventory. It's a pain as it cannot be ignored, even by clicking 'irrelevant attribute'.

I'm not sure if it's a glitch.*

If not, it's another indication that Amazon designers have lost the plot when it comes to the used book market (which is where it all started for 3rd party sellers, ironically).

*There are some old threads on the topic (relating to DVDs and CDs rather than books) where it is suggested that entering '0' is the solution but it would be good to have this confirmed by a mod.

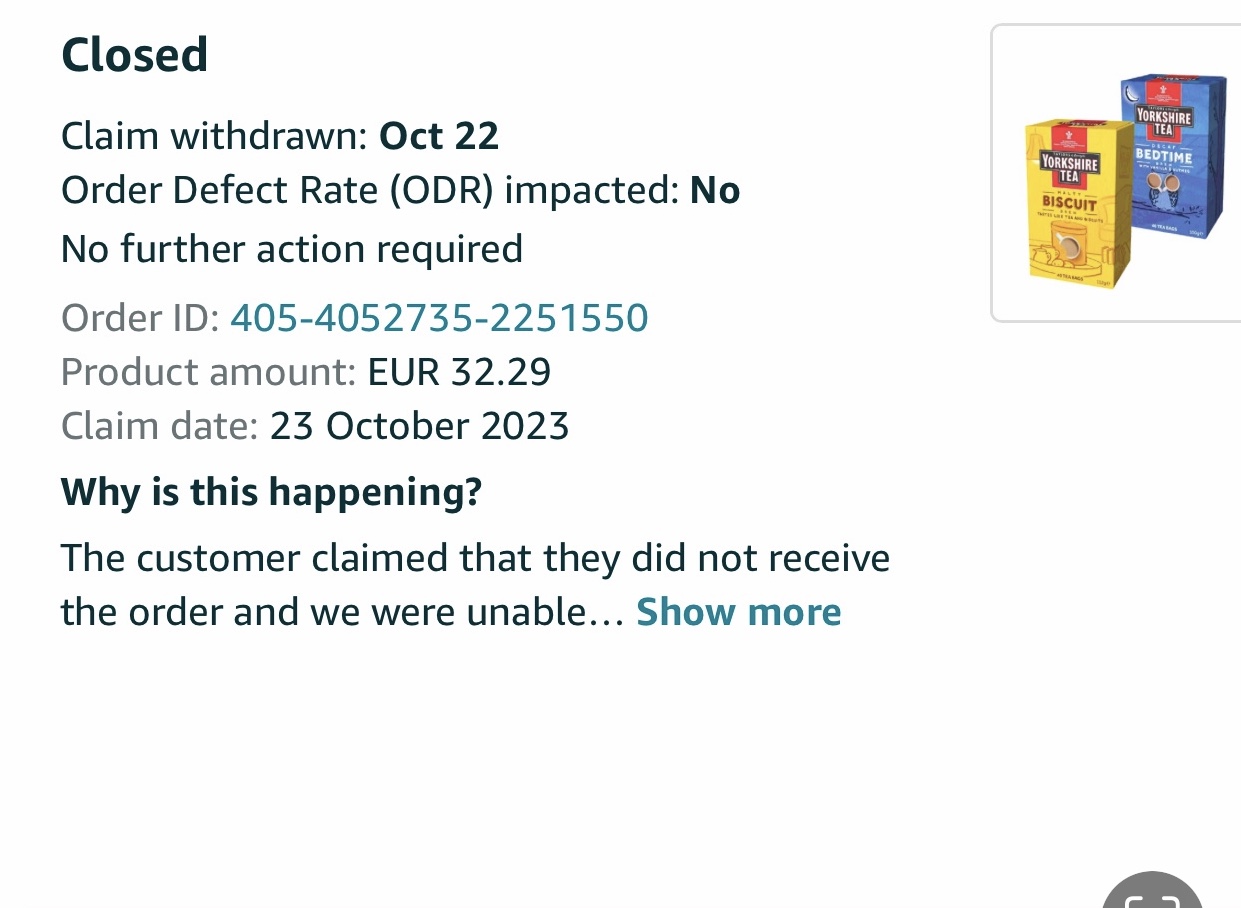

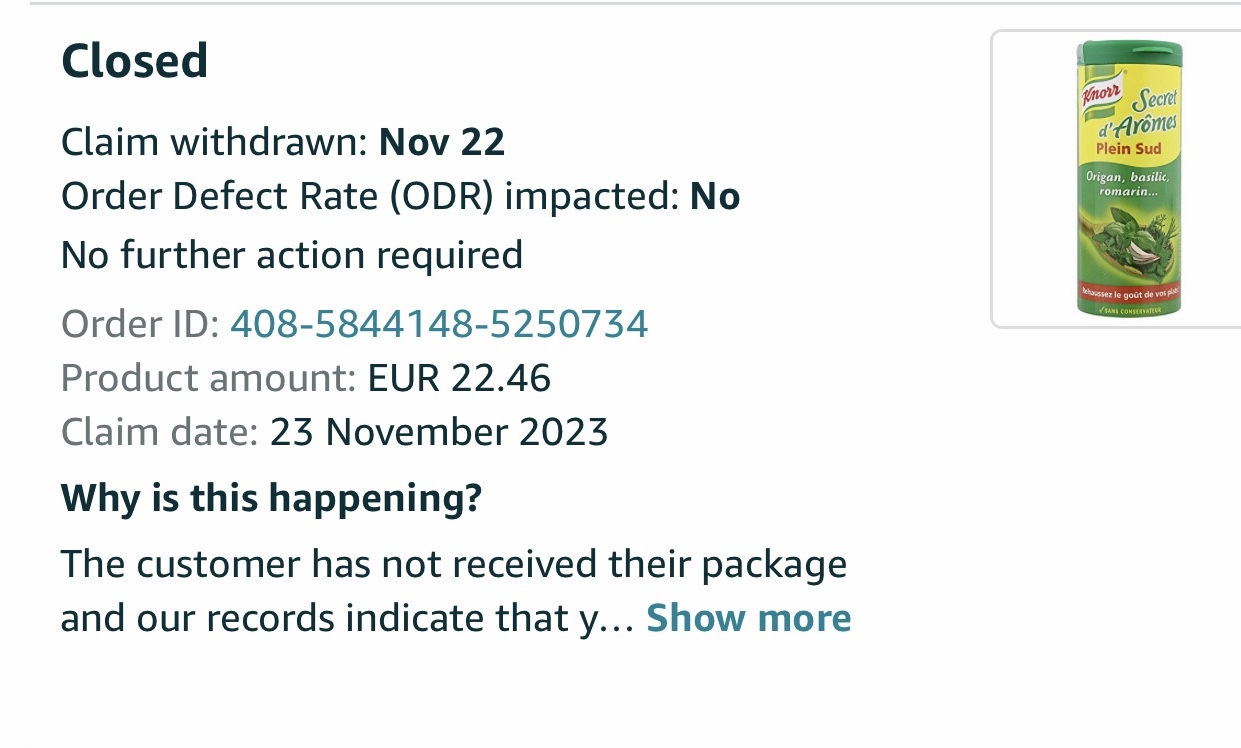

I sell many items in the European marketplaces, for many reasons (none that I or any individual could possibly control) such as the Amazon IOSS number not being accepted by customs, customs errors like double charging the tax already collected by Amazon, items wrongly classified as restricted and many other issues, I have many A-Z claims for items not received, I usually contact the customer and resolve the problem, usually I send the items again. Obviously I get the buyer to withdraw the claim and the majority understand that the issue is from Brexit issues and not my error and they are happy to cancel the claim and allow me to fix the problem. This is now where the problems start, Amazon has been reversing the buyers decision to close the claim and they reassess the claim and grant it. This has been happening for years now and without exaggerating I must have contacted Amazon over 500 times about this issue. I show them the tell tale signs and I even contact them before they reassess the claim to tell them that it is going to happen (their usual answer is to tell me the claim was already closed). The signs that there will be an issue are I don’t receive notification of the claim being closed and the claim date and claim withdrawn date. Usually these are displayed incorrectly. I’ll just show you guys what I mean:

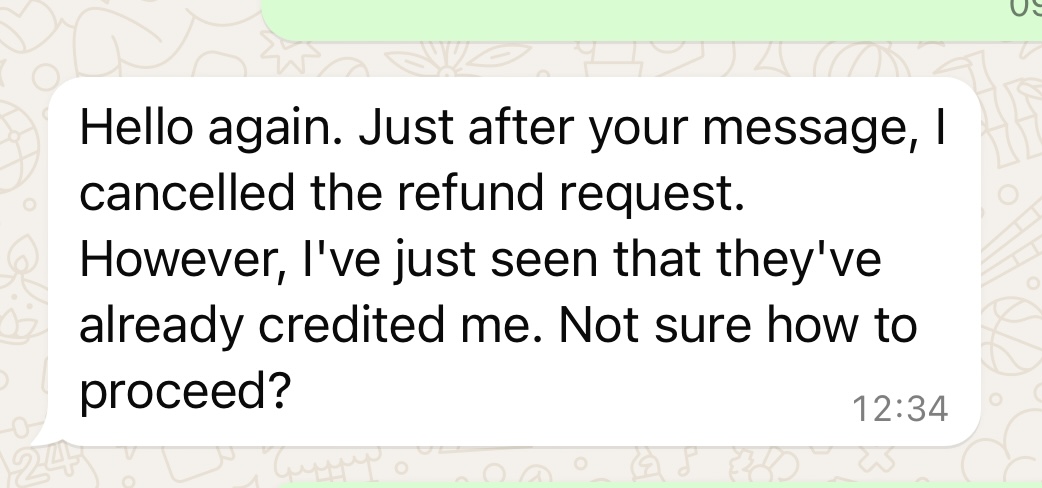

So apparently these people are opening the claim the day after they closed it, am I meant to believe that these people are time travellers? How is it possible that they managed to close the claim the day before it was opened? According to Amazon this is normal! Any normal person can see there’s something wrong, when I call up Seller Support the people on the phone understand there’s an issue, when I speak to a supervisor they also understand however when my case is transferred nothing is done. This has been happening for years without resolution. Just yesterday I received a claim from a customer in Sweden, he requested I resend the order when he returned from holiday, he cancelled the claim at 9.44am and at 9.53am the claim was granted again. Today another customer opened a claim and then closed it within a few minutes, I again received no notification but I did receive an email around 2 hours later telling me the refund was completed. Here are the words of the customer:

How can this be acceptable? I already sent the product to the client and tracking shows that the parcel will be delivered tomorrow and now because of Amazon’s error the customer has the refund as well as the order. The worst part is the original problem is nothing to do with me and I’m the person fixing the issue, it’s so demoralising to work the problem out with the customer only for Amazon to wipe all that work out for no reason and then to deny it’s happening when I have presented volumes of proof.

@Seller_DNQGSsdC7DccM

@Seller_mIRnuhdx7l5sN

@Seller_gAhPNiLrkfTcr

@Seller_Huz6FT08OxHAR

@Seller_hnDMgUKxMh1V4

@Seller_XUNeUuvrQDpgP

@Seller_TSXM2A5nxWSuH

For me, they let me select again and I am going to select the established option now - submit the 4-6 documents they want.

I think this is more like an annual verification check to check if you still exist.

Where i misunderstood is I though all UK establishments are VAT reg.

- © 1999–2024, Amazon.com, Inc. or its affiliates