Sort by

Filters

Results for "66세컨유심파는곳⤻(텔레𝐛𝐥𝐚𝐜𝐤𝐮𝐬𝐢𝐦]막심거래≧대부유심파는곳➻pc카톡팝니다⬑pc카톡인증업체≉"

(276 results)

hello,

I would appreciate some help if possible.

I have had my UK selling account deactivated for almost 6 weeks due to a high ODR %. They seem to think I simply marked orders as sent without sending them

Since the account was deactivated, I have spoken to Amazon Account support staff almost 30 times. Each time they suggest adding new information to my appeal and still I continue to receive the same rejection template email.

I have provided explanations and documentation for everything that has been requested plus more.

Originally, I was asked to provide proof of delivery for last 30 days. Then 60 days. Then 90 days.

Not only have I provided detailed excel spreadsheets with orders going back last 6 months which include tracking numbers, delivery status, refund status if so and reason for this, but I have also supplied picture proof of over 100 deliveries. I have provided my Incorporation documents, banking information, POA and a letter from the courier.

As everything has failed thus far, I tried to escalate my case to the MD office but I keep getting the same rejection emails or no replies at all.

It seems as if Amazon no longer cares much about helping Sellers reactivate their accounts.

Any help would be appreciated as this has become very frustrating and tiresome.

I’ve had deactivations previously and they lasted anywhere between 4-18 months. It’s fair to say, I cannot afford to be waiting that long again without access to funds that are being held.

Regards

someone please help

@Seller_TSXM2A5nxWSuH

@Seller_hnDMgUKxMh1V4

Hello, I have been talking to amazon for weeks now about inventory that we sent that they claim the contents didnt arrive.

The next step would be to take them to small claims court. Has anyone done this before?

Just to explain what happened: we send boxes to Amazon on 1 May 2024 via their own UPS service. They were tracked and delivered. The boxes were 15kg each (two inner cartons) with 32 units per box (around 330g each). Totalling 64 units.

They started checking them in, then weeks passed and the checked in quantity stayed on 0. It then eventually said that the shipment was complete and that it was short by 64 units(!).

I made the online request on the shipment for a review, and they said they recounted the stock across the warehouse and found 3 extra products of ours, but a different SKU (I assume this was nothing to do with the shipment, but just three extra items after a re-count)

I contacted them and asked them to investigate, after two weeks they came back and said that the investigation was complete and that they didnt receive any goods. They scanned in the boxes, the boxes were 15kg each. So how on earth have no items been checked off. According to their logic the boxes must have been empty because, of course, they cant possibly have lost the stock or boxes somewhere.

Is the next step making a claim through the courts? Any advice would be appreciated.

Hello,

I am new to Amazon, Just opened my account today. I am thinking about launching a small business for PC and Phone accessories? I would like to receive some advise on how to launch my business? What steps I will need to take? will highly appreciate your advise!

Best regards

Nizamuddin

Order 026-3242530-0140301. Case Id 9731342262. Customer wanted to return product and amazon customer service had customer return it to their fulfillment center and now wants us to issue the customer a refund while our inventory is lost in their warehouse. We have no way to recover inventory and amazon policy states no refund needs to be issue until inventory is returned to us.

Requesting a MOD help me get to the bottom of this. All of my listings have been made inactive in all of the European countries pending my identity verification. (We do millions a year on amazon UK+DE + rest of EU , so each day we are losing many thousands of dollars in revenue)

Amazon says you have 60 days to provide this information or your account will be disabled. Their first contact with me was May 21 2024, they disabled my account June 12, 2024. I have been dealing with this for over a week now. Each time they contact me, they ask for more documents without explanation. Why don't they just ask me for everything they need right away? Why did they go against their policy and disable my selling account before the 60 day period? Can a mod please help? I've had 7-8 calls to the account health team and they are zero help.

Timeline went as follows:

- May 21, received first email requesting identity verification docs.

- May 27, second email second email requesting identity verification docs.

- May 28 I received a call and email. I said that I was on vacation from May 20-30 and would get to it as soon as possible. I noted in the emails it said I had 60 days.

- June 12, account deactivated with (Action Required) Information needed for selling account. One of the following documents issued within the last 180 days:

-- A fictitious business name statement

-- A "doing business as" (DBA) document

-- A valid (not expired) business license

-- A document confirming payment of income tax or self-employment tax

I provided them with A EIN business license from the IRS, and a scanned copy of my passport. They asked for more.

5. June 12, Hours after I sent the EIN, they sent another email asking for more documents. Account is still deactivated. (Action Required) Information needed for selling account.

One of the following documents issued within the last 180 days:

-- A fictitious business name statement

-- A "doing business as" (DBA) document

-- A valid (not expired) business license

-- A document confirming payment of income tax or self-employment tax

I provided my DBA and a Bank account statement with my DBA in the title and my address and full name clearly stated on the PDF. The next day, they asked for more.

6. June 13th. They asked for a "Certified bank letter" with the following requirements.

-- The document must be dated within the last 180 days.

-- The document must show the bank name and the bank logo.

-- The document must be signed or stamped by the bank.

-- The document must include the account holder's name, residential address, and bank account number.

I went to my bank and they created a certified letter, stating my full name, my DBA, the full account name, and everything they provided on their certified letterhead. I even took a photo, holding up the letter, and my passport, inside the bank, and sent that as well.

7. June 17th. They asked for MORE documents. Address verification documents:

Here is what they are requesting. Keep in mind, I have already submitted my bank statement. So they are requesting the same document twice here.

For the primary contact person, provide a copy of a proof of address document. We can accept any of the following documents:

-- Council tax bill

-- Utility bill (gas, water, electricity, TV, internet, mobile phone, or landline)

-- Bank statement (Documents issued by a financial services provider, such as third-party providers or online digital banks, are not acceptable as a proof of address.)

-- Credit union or building society statement

-- Credit card statement or bill

-- Mortgage statement

-- Rent receipt from a local council or letting agent

-- Benefits agency letter (such as from the Department for Works & Pensions, Job Centre Plus, or Veterans Agency) confirming your rights to benefits

Ensure that the document meets the following criteria:

-- The document must show the individual’s name and residential address, as well as the provider’s logo.

-- The document must be dated within 180 days.

-- For a council tax bill only, the document must be valid for the current tax year.

-- The document must not be a screenshot.

-- The information in the document must match the information in your Seller Central account.

So I sent them a SCANNED copy, of my mortgage statement. Since they didn't accept the PDF download of my bank statement.

Based on amazon's own policy, it would appear my account was disabled before it should have. Not to mention the ridiculous amount of documents they are asking for. Every email, I give them what they want. Why are they asking for more? Why not just ask for it all at once? What else do they need from me? What will they ask for next? DNA sample? At this point, I don't care what I have to do, I just need my account active so I can continue selling. It's not just the money lost, that I can never get back, its the ranking we lost, which will take weeks if not months to get back. The losses are staggering, and for an account of our size, to be going 4 days in-between contact, is blowing my mind.

I did not want to post, but I just don't know what more I can do, im losing my mind over this.

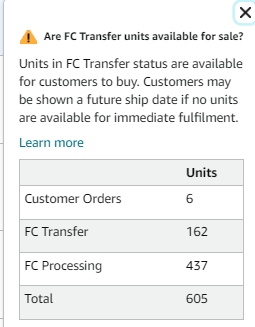

My products are in the Amazon warehouse. But recently a lot of stock has been converted to ‘FC Processing’. It will be out of stock soon. What should I do? Please help me.

Hello,

I recently received an email from amazon in regards to verifying establishment for value added tax to prove im UK Eligible.

I received this email -

Hello,

Thank you for your submission. We reviewed the information provided, but we need additional documentation to determine whether you are established in the UK for Value Added Tax (VAT) purposes.

Why did this happen?

We must collect and remit VAT from non-UK established selling partners for the sales of goods delivered to customers in the UK. Based on a review of your account, we determined that you may not be UK established for VAT purposes. We leveraged a combination of automated means and expert human review to identify this issue and make this decision. We took this action in accordance with the Amazon Business Solution Agreement:

https://sellercentral-europe.amazon.com/help/hub/reference/external/G201190440

and APUK Agreement:

https://sellercentral-europe.amazon.com/help/hub/reference/G201190400

What actions do I have to take?

To avoid further impact to your disbursements, go to the Account Health page in your Seller Central account and follow the instructions from the banner that is present at the top of the page to submit the following mentioned documentation:

https://sellercentral-europe.amazon.com/performance/dashboard?ref=DR_kyc_ahd-cus

If you operate a Limited Company :

1.Evidence that you are physically operating your business from your provided address.

You can provide any one of the following documents :

-A recent UK council tax bill or business rates of the current year, addressed to the company or a director of the company.

-A recent utility bill dated within 180 days addressed to the company or the director of the company.

-If you are using a shared working space, you can provide one of the following:

A recent license agreement

Copies of invoices for payment of rent

A proof of payment of rent.

The document must be in the name of the company or the director,with the shared working space provider, for a period of 6 months or longer.

2.Provide the below document for proof of operational business address.

-A copy of an invoice addressed to the company at its primary place of business for goods or services used to operate its business. It must be dated within 180 days.

If you do not meet the UK establishment criteria: Verify that you are not established in the UK.

In this case, you will not need to provide documentation, but you will need to pay Amazon to account for the un-paid VAT.

We’re here to help

For more information, go to "UK VOEC: Determination of Establishment":

https://sellercentral.amazon.co.uk/gc/vat-education/voec-uk-establishment?ref=DR_kyc_ukhp

If you have additional questions and wish to speak to an Account Health specialist, go to "Contact Us" on your Account Health page:

https://sellercentral-europe.amazon.com/performance/dashboard?ref=DR_kyc_ahd-cus

Amazon Services Europe

However I've sent over : Phone Bills, Companies House certificate, passport, driving license, bank statements, goods invoices.

This still isn't allowing them to verify me, does anybody have any advice? Thanks!

hi, trying to ship a pallet into the UK DC.

4 rows high on a pallet comes in at 1524mm, excluding the pallet (approx 150mm)

FBA is saying it needs to be split across 2 pallets?

I can't seem to find an official source on max height, but the info I have says it it 1.8m, so I should be under that?

any official requirements on this?

cheers

Hi my account is stuck in a loop, i have tried contacting customer service multiple times and they keep copying and pasting the same response. I have updated the information like they asked with no update whatsoever. It is now been several weeks with no progress. What's an alternative way to reach out to them? Is there any human left working at amazon customer service or are they all bots?

Here is the email they keep copying and pasting:

This is an urgent request for you to provide additional information about your account to complete the verification.

Failure to respond to this request as soon as possible may lead to your disbursements and listings being temporarily deactivated.

Why is this happening?

You have incorrectly selected the individual legal entity during the registration of your Amazon selling account.

What do I have to do?

To proceed with the verification, register your account with the correct legal entity.

What happens if I do not provide the required information or documents?

You have a total of 60 days from the day when we first contacted you to provide all of the requested documentation or information to complete the verification. The time that we take to review and validate this information will not be counted against the 60-day threshold that you are given.

Failure to provide this information before the 60 days will lead to your disbursements and listings being temporarily deactivated until verification has been completed.

If it has been more than 60 days since we first contacted you, your disbursements and listings may have already been deactivated and will remain deactivated until the requested information or documentation has been provided and your account has been verified.

Use the following information to select the correct legal entity:

-- Individual: Select this option if you do not intend to sell on Amazon commercially or professionally. This option allows you to sell personal items that you no longer want or need, for example, old DVDs or books.

-- Sole Proprietor: This legal entity is applicable for any commercial individuals who sell for profit. A sole proprietorship is usually registered with local authorities. There is no legal distinction between the owner and the business.

-- State-owned business: This is a business that is either wholly or partially owned and operated by a government.

-- Publicly-listed business: This is a business with shares listed on a stock exchange for public trading.

-- Privately-owned business: These entities, such as limited companies or partnerships, are businesses controlled and operated by private individuals.

-- Charity: This legal entity is for foundations, organizzazione non lucrativa di utilità sociale (Onlus), società cooperative sociali, associations, and other tax-exempt bodies.

Dear sellers,

Our freight company has told me that my order is supposed to be delivered to Amazon UK LBA4.

Due to LBA4 is busy, Amazon informed our freight partner to redirect the cargo to LTN7, does it affect the inventory update time? Does Amazon will finally internally move my cargoes to LBA4 from LTN7?

Thanks,

- © 1999–2024, Amazon.com, Inc. or its affiliates