Sort by

Filters

Results for "69카카오톡파는곳∵⸨텔그𝘐𝘚𝘌𝘜𝘓𝘛𝘈𝘓𝘒⦌pc카톡사는곳≳010인증판매†카카오톡판매◡카카오톡인증◪"

(446 results)What is a good PC program for filing UK HMRC taxes? I've been doing it manually on the HMRC website, but they suggested using a computer application. Any recommendations?

I send around 100 large letters ( £1.55 ) per month and find that 20-30% dont have delivery confirmation - so it's worth checking delivery , even if you dont get a customer complaint , because you can claim compensation for all those without confirmation ... if each item is worth £20 that's an extra £200 - £300 per month compensation from royal mail .

very rarely have non delivery for tracked 48

Fellow sellers, I'm seeking some advice on a frustrating situation I've encountered with another seller undercutting repeatedly.

I initially found a product with great profit margins over 100% ROI and there is about 10-15 sellers. I matched the current Buy Box price and sales were going well for about a month. Then yesterday, another seller started hugging the Buy Box, going just 1p below the current buy box.

It's evident they are using a repricing tool to constantly undercut the lowest price by 1p in order to solely maintain the Buy Box themselves. While I understand the motivation to capture all the Buy Box sales, it's exasperating when sellers configure repricers so aggressively just to box others out.

This particular seller has over 200 seller feedbacks, so they are an experienced seller who surely understands pricing strategies. As a result of their relentless undercutting, my potential ROI on this product has plummeted from over 100% down to only 5-10%.

I've now sold out of my inventory for this item. My question for everyone reading is would you continue sourcing more of this product knowing you'll likely just enter another Buy Box battle? Or would you cut your losses and move on to other products?

I'm all for healthy price competition, but it feels unethical when sellers setup repricers to continuously undercut by the smallest increments just to own the Buy Box. I wish we could agree as a seller community to share the Buy Box rather than trying to monopolize it. But I realize that's unlikely to happen.

Any thoughts or advice on how to approach this type of situation would be appreciated.

Here's to better seller karma for all of us.

Hello Let me explain the whole story in a few words.

Starting on 10 April 2024

Amazon indicate to us we need to pay GBP 47,258.28 VAT starting from 2021.

You can continue to sell, but your Amazon sales proceeds will remain temporarily ineligible for disbursement from this account, and any related accounts, until any UK VAT owed is paid to Amazon.

The company behind this account was established in August 2023, so it is impossible to have VAT from 2021.

According to the notification you (AMAZON) indicated to me, you also have to pay GBP 47,258.28 VAT ... THIS THING IS NOT POSSIBLE because we have not even generated sales of this amount, so we should have so much VAT to pay, which is wrong.

The company was founded in August 2023, so it is impossible to have VAT from 2021 to pay.

Until September 2023, the Amazon account belonged to a UK-based company whose owner was a UK resident for whom Amazon collected VAT.

After many many emails with drtax-vatliabilitysupport@amazon.co.uk we send all the document requested like: id, passports, driving licence, contracts, bills, banck statments, invoice .... etc.

Since April and until now, no concrete answer, every time I send an email or open a case, the same answer is returned to me:

//////

Hello from Amazon Selling Partner Support,

My name is Guillaume and I am contacting you regarding your VAT liability request. Thank you for your patience in this case. I understand how important this is for you and I am glad to assist you the best possible way.

Please let me inform you that our internal teams are working actively on your case. There is no action required from your side and I will keep you updated about the process.

Thanks again for your patience. We remain available.

Have a nice day !

//////

Hello from Amazon Selling Partner Support,

We understand how important is this matter for you. In response to your inquiry regarding the VAT applied to your invoices, we would like to inform you of the following:

The corresponding department is still working on your case and we will get back to you as soon as we have further information to provide.

We appreciate your patience and it was a pleasure to assist you.

Thank you for selling with Amazon.

///////////

on 19 June:

Hello from Amazon Selling Partner Support,

Thank you for your patience. At the moment, I am working with our internal team to reach a resolution on your case. While I don’t currently have an update, I will follow up with you as soon as additional information is available.

Thank you for selling with Amazon.

Sara B.

//////

3 months have already passed and nothing.

Does anyone know how soon the verification will be completed?

Can anyone help me speed up the verification process?

Very bad impact on store sales near to zero for 3 months.

Thank you

any help is highly appreciated @Seller_DNQGSsdC7DccM @Seller_gAhPNiLrkfTcr @Seller_yk3kzHpjMMa4B @Seller_VJ4XoAkjDpjPH @Seller_Huz6FT08OxHAR @Seller_fgtTzyHQfOM1x @Seller_TSXM2A5nxWSuH

Does anybody have any experience of using a PO Box address on Amazon, especially for returns?

We have been on Amazon for over 10 years, so not a new seller. We are moving from our business premises in a few weeks and will be using a residential address for a period. We do not want our residential address publically available for security reasons and have set up a PO Box address. This is no issue on any other marketplace or our website, but Amazon seem to be less than helpful with these type of changes.

All other business information will remain the same - company name, registered business address, company number, VAT number, contact details etc

- The return address will need to be changed to the PO Box address so that customers do not have our residential address.

- The ship from address can remain as our residential address if this information is not publically accessible and used only internally by Amazon. If it is shown publically then this would also need to be changed to the PO Box address.

Does anybody else do something similar or have any experience of it?

Thanks in advance

@Seller_gAhPNiLrkfTcr

@Seller_z3k8APxGfbQEK

@Seller_TSXM2A5nxWSuH

I have had over 30 parallel import claims in the past 6 months. It seems to be the go-to loophole for brandowners trying to illegally limit competition. Ive been able to appeal succesfully for the most part but then they just resubmit and deactivations are back.... These brand owners are getting the tools to break anti-trust laws in bulk, there should be an investigation as soon as possible. Ive opened many many cases and many were escalated, but no response. I even have written proof of cases where the brand owner even admits to me that it has nothing to do with parallel import, they just dont want us on Amazon.

Correct invoices are rejected because the reviewer is not properly trained to understand parallel import, the product even has an EU flag on it + the brand owner itself is selling on the listing with the name "<BRANDNAME> EU", like how much proof does one need. But no, once identity of brand owner is confirmed, they can block others from selling the product they sell in the same market = 100% ILLEGAL.

Some items they say in their complaint that they did tests orders but we have 0 orders for them since the start. Its ridiculous.

Our BE store is currently deactivated on 5 remaining cases and forgiveness path for Parallel import claims is gone despite all the succesful appeals, we are pushed in a corner.

Legal action against these brand owners is my next step.

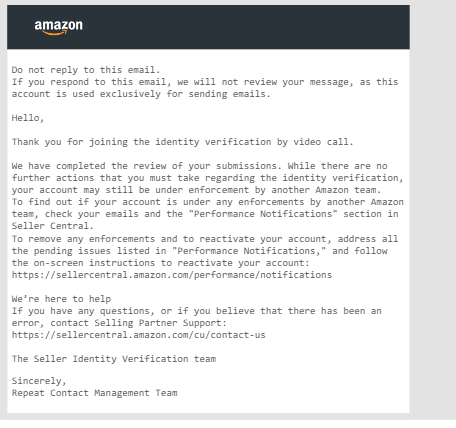

Hello. our account was deactivated on 11 april 2024 and funds were hold. upon enquiry with multiple teams on emails, we waited for 60 days. now today on 21 june 2024 we had our interview call done for identity verification. we received email after the interview as mentioned below. i would like to know when the funds will be released as the person only verified my passport and ask few basic questions only. it went smooth. and what enforced team they talking about? as my account deactivated due to recent VAT issue. i will resolve it with the team once the funds will be released as per amazon withhold policy.

@Seller_z3k8APxGfbQEK@Seller_hnDMgUKxMh1V4@Seller_Huz6FT08OxHAR@Seller_yk3kzHpjMMa4B your help will be appreciated if you could get this sorted asap and get my funds released please.

I am doing FBA and Amazon keeps the buy box with 6-7 months of shipping time on some of my listings. How on earth can it be possible? It cannot be accepted as a normal shipping time and there is no chance to beat those prices. Amazon does not allow us to win the buy box.

it depends on the product, if I have a product that sells relatively well, have few or no returns, doesn't require much packaging, I am happy with 15%/20%. I agree with you, it's important to focus on the bottom line, what other sellers do or how much you sell is not important. I am up 67% from last June and yet I sell less products.

Seller_soBD2wwhsVOww

Can anyone help

I have been running round in circles since the 5th of this month

Having received and order for 6 variation of the same product I realised that I was been charge a higher rate for 5 of them

When checking it showed that the lower costs was for grocery items and the higher for Home and Kitchen

I sell under the department Grocery

With sub categories Food Cupboard > Baking Supplies > Icing & Decorations > Decorations > Cake Toppers > Cupcake Toppers

I have a product Tax Code: A_FOOD_CAKEDECOR

I do not own any ASINS just SKU’s and the ASIN’s were assigned via Amazon at upload.

I have been told that the products should all be in Home and Kitchen under cake topper

Why is it then that as I was approved to sell under Grocery, have all my products listed under grocery I should be paying the higher rate under Home and Kitchen.

Apparently, it’s because- that they feel Home and Kitchen is the right category for me to be billed under despite my listing under grocery.

I did sent a more detailed reply to @Seller_XUNeUuvrQDpgP Post 5 days ago though no reply so am reaching out to see if anyone can help at all

I own the brand and all products are branded and 100% edible

- © 1999–2024, Amazon.com, Inc. or its affiliates