Is there a VAT on EU FBA fees or not?

There are three different Amazon fees on a single sale for EU FBA item:

Amazon Commission Fee – (15%) + VAT (claimable from the UK)

Digital Fee – VAT included (claimable from the UK)

Amazon FBA Fee – No VAT applied

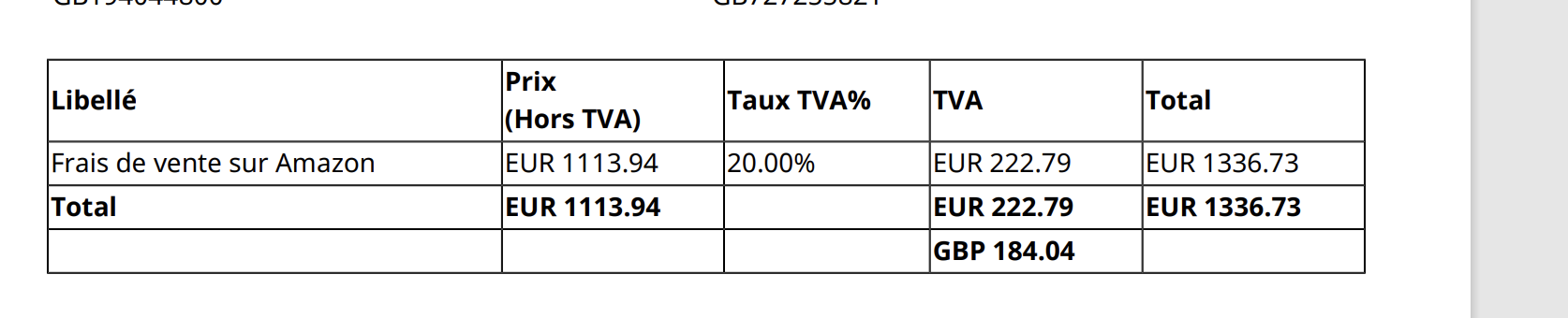

Under Tax Reports, I found invoices, and one of the France invoice descriptions is: "Frais de vente sur Amazon", which translates to "Amazon Selling Fees."

Does this mean the invoice includes Amazon Commission + VAT, or is it referring to something else?

If these are Amazon commission fee invoices, where can we find the FBA fee invoices and digital fee invoices? I’ve checked under Tax Reports, but I can’t seem to find them there.

Would you be able to guide me on where to locate them?

Thank you

9 replies

Seller_2EG6N58tYDYmC

Anyone?

Character count must be at least 20