AMAZON REFUSES TO REFUND VAT AND IN CONTEMPT OF HMRC LETTER

Hello all, I applied for VAT refund to HMRC based on Amazon VAT Invoices. HMRC issued an official letter which stated that my UK company is NETP (non-established taxable person) and Amazon should have never applied VAT on any invoices issued to my company (VAT on ads, commissions etc.). HMRC also stated unequivocally that Amazon must reimburse me for the overpaid VAT.

Currently, I have over 13.000 GBP due from Amazon and Amazon refuses to refund this VAT amount in clear violation of HMRC's order.

Here is the reason: Amazon requires me to have the same business address across Seller Central, VAT invoices, VAT Certificate, and Certificate of Incorporation since 2021. Whoever invented this requirement will cost Amazon millions for non-compliance with HMRC rules and orders. Here is why this requirement is wrong and cannot be met by any NETP UK company:

1. My NETP UK company has changed UK office address three times since 2021, all can be tracked through Companies House registries. After all address changes, Seller Central information was updated accordingly. Amazon reuires me to match all addresses across Seller Central, VAT invoices, VAT Certificate, and Certificate of Incorporation since 2021. How is this possible if there is an address change?

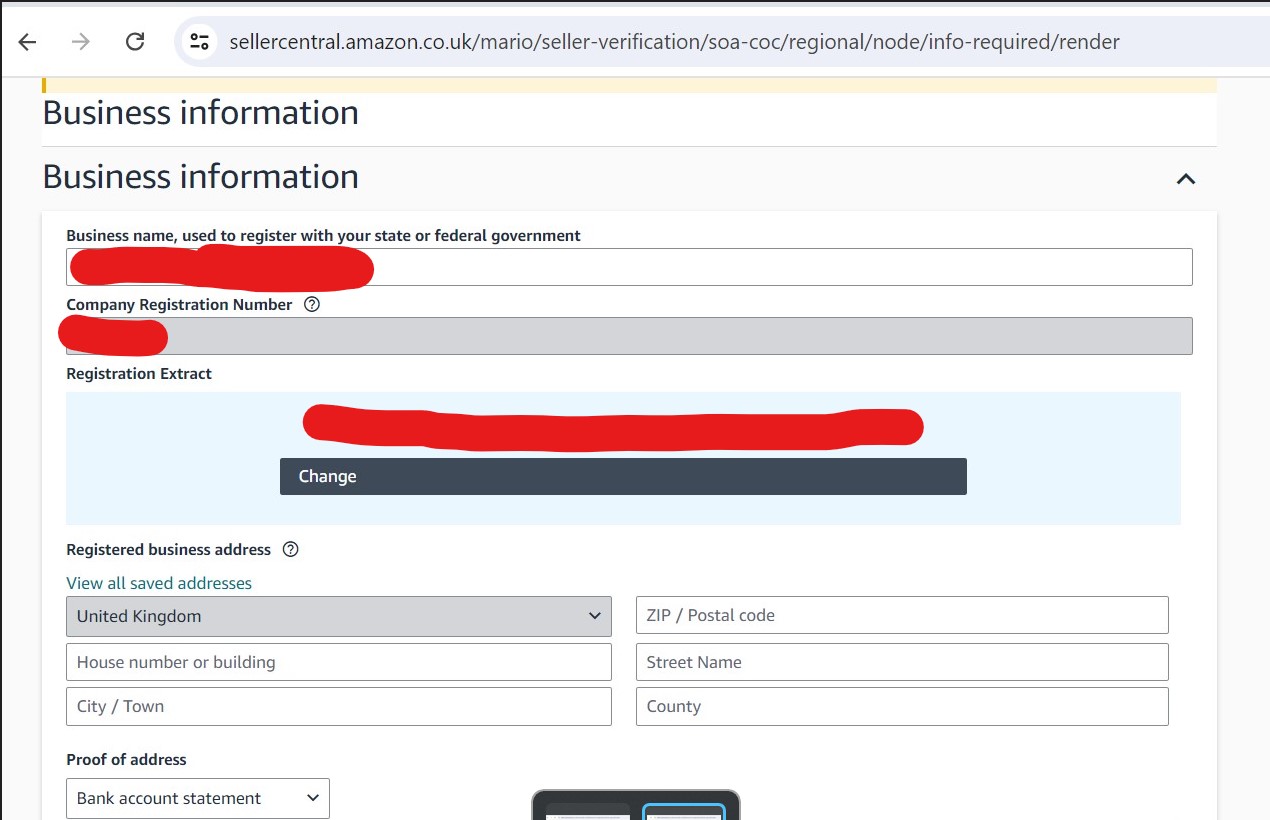

2. When HMRC registers NETP UK companies for VAT, they use non-UK foreign addresses in the VAT Certificate. There is simply no way for HMRC to put the Companies House address in VAT certificate, so they used my Turkish address where I run my day-to-day business. On the other hand, Amazon's system does not allow UK companies to put non-UK addresses in their system (please see attached screenshot). So all VAT invoices were issued to my company's UK address. How could I possibly put the same non-UK address to the Seller Central while Amazon's system does not allow it?

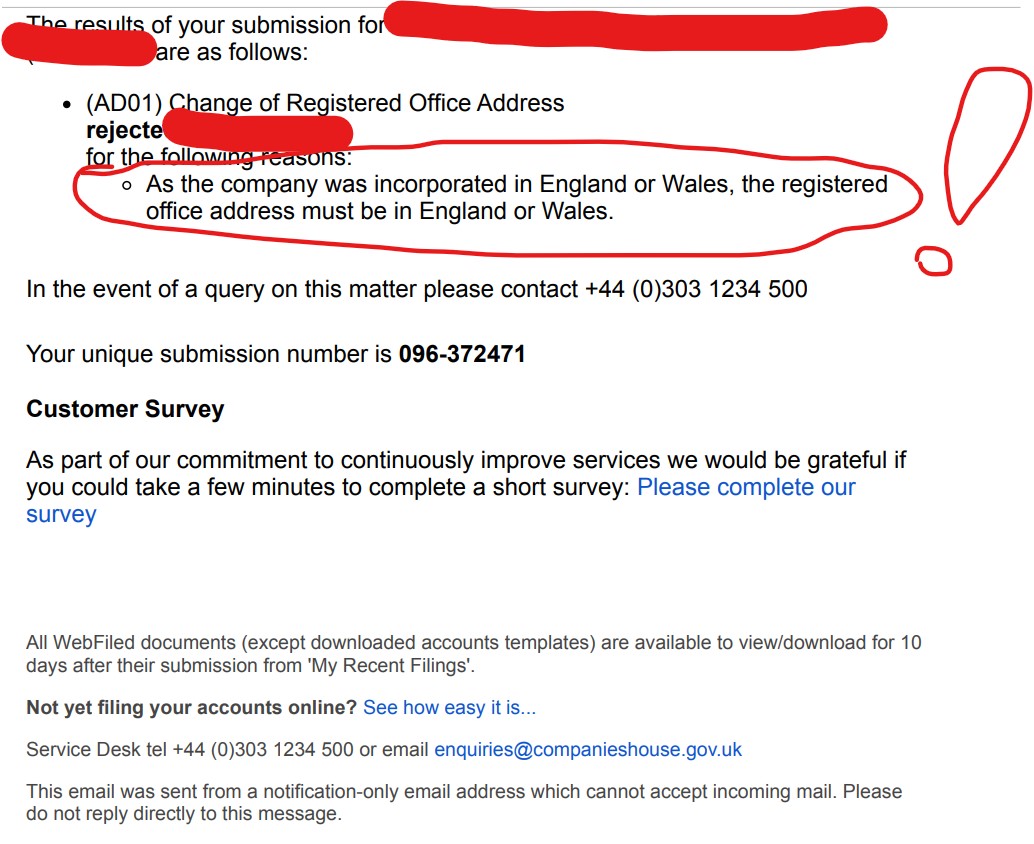

3. Amazon also requires the address on the Certificate of Incorporation to match the VAT certificate and Seller Central business address information. However, Companies House only registers UK companies with a UK address. Here below is a screenshot when you try to register or change the address of a UK company using a non-UK address:

CASE ID: 10643881102.

Seller Support has been unhelpful because they do not read and understand anything.

In summary, Companies House uses UK address in the registry for NETP UK companies, HMRC on the other hand uses non-UK address for NETP UK companies and Amazon wants me to match all addresses across different documents to be the same for the last 4 years.

I need your help to get this issue resolved for good. Thank you.

6 replies

Seller_MT8rt0A2OpbCx

Based on what you said, you should have all your addresses as your Turkish address, where you actually run the business from. You shouldn't have a UK registered business on Companies House. As Amazon seem to only have you as a UK business, they are legally required to charge VAT. However, as a NETP, they should be deducting VAT on all your UK sales and paying that directly to HMRC. Is this happening?