Countries

Read onlyUS Amazon funds are still on hold because of VAT on eCommerce legislation for my UK Amazon account.

On May 9, I received a notification on my Amazon UK account, stating: 'This is a reminder that the disbursements of part or all of your Amazon sales proceeds remain temporarily withheld in all stores you operate worldwide... We must collect and remit VAT from non-UK established Selling Partners for the sales of goods delivered to customers in the UK. Based on a review of your account, we determined that you may not be UK established for VAT purposes. This may have resulted in inaccurate tax treatment on your sales under the VAT on eCommerce legislation (effective January 1, 2021, in the UK).'

Even though my UK account has been disabled since 2022, I understand that Amazon is tracking me to pay the VAT for the sales I made from 2021 until my account got disabled. I don't have any option so I acknowledge that I owe Value Added Tax (VAT) to Amazon and clicked the button for understanding what repayment options I have, and still waiting for Amazon to reply me on how much I owe and the payment option.

My question now is how long Amazon will take to calculate my VAT amount and provide me with the options to pay. How many percentages will be the VAT, and will it be calculated from the total sale amount or for the amount Amazon paid me after their cut?

Another question is why Amazon is holding my US account funds for the UK account issue, even though both accounts are completely different entities in both countries?

0 replies

Seller_eb92qxnXffpRM

@Spencer_Amazon

How long will Amazon take to calculate my VAT amount and provide me with the options to pay? I need funds to run the business and survive; I can't be in this situation where all of my funds are on hold. If I owe VAT, I will pay and keep moving. Please advise on how long it will take.

Seller_rI7BZIczK8iAC

"I understand that Amazon is tracking me to pay the VAT for the sales I made from 2021 until my account got disabled."

Amazon doesn't do this because they like additional work. They do it because the UK (and all European) governement is forcing them to do so.

"How many percentages will be the VAT,"

The UK governement takes the total of your sales in UK and you pay the UK VAT. How much in percentage? Ask Google.

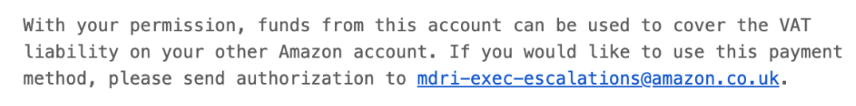

So, to resolve once for good this thing, go look in Amazons email and you will see following:

Write an email to that address instructing Amazon to use your US reserve to pay your UK VAT. And magically your funds will immediately be released.

OK, it took me 15 minutes to write and search in my database. Always a pleasure to help.

Atlas_Amazon

Hello @Seller_eb92qxnXffpRM

"Based on a review of your account and the information provided, we have concluded that your business is not established in the UK for Value Added Tax (VAT) purposes."

Thank you for the information provided regarding the issues on your account. I understand that our team has been looking into the recent concerns regarding your VAT information. I have gone ahead and ensured that your information has been transferred to the appropriate teams.

Please continue to refer to this thread with any updates or questions you have on the situation.

Best,

Atlas

Seller_EZgkOeAlm9mKh

Hey @Seller_eb92qxnXffpRM,

I'm in the same situation as you.

I transferred my UK based business to a NON-UK based company last year in August. And since then only sold in USA & CA. Now on the exact same date as yours, 9th May 2024, Amazon has withheld our disbursements.

They claim I have to pay a 5 figure some, but my UK based business has already paid the taxes.

On top of that Amazon fails to review for nearly 2 full months the UK establishment for my UK registered company.

I've submitted my company documents, my VAT certificate, all UK Government certified documents and yet they fail with a simple 2min check. They provide several links for checking the VAT number, I share those documents and yet, the fail once again.

Has your issue been resolved yet? Have they offered you a payment plan? What options are there?

@Atlas_Amazon, @Micah_Amazon, @Bryce_Amazon, @Emet_Amazon, & other mods, serious help would be extremely appreciated.

Kindly refer to case ID 9914532612 - 9825228622

Thanks.

A Founder