VAT Refund On Selling Fee's - No Update???

Hi,

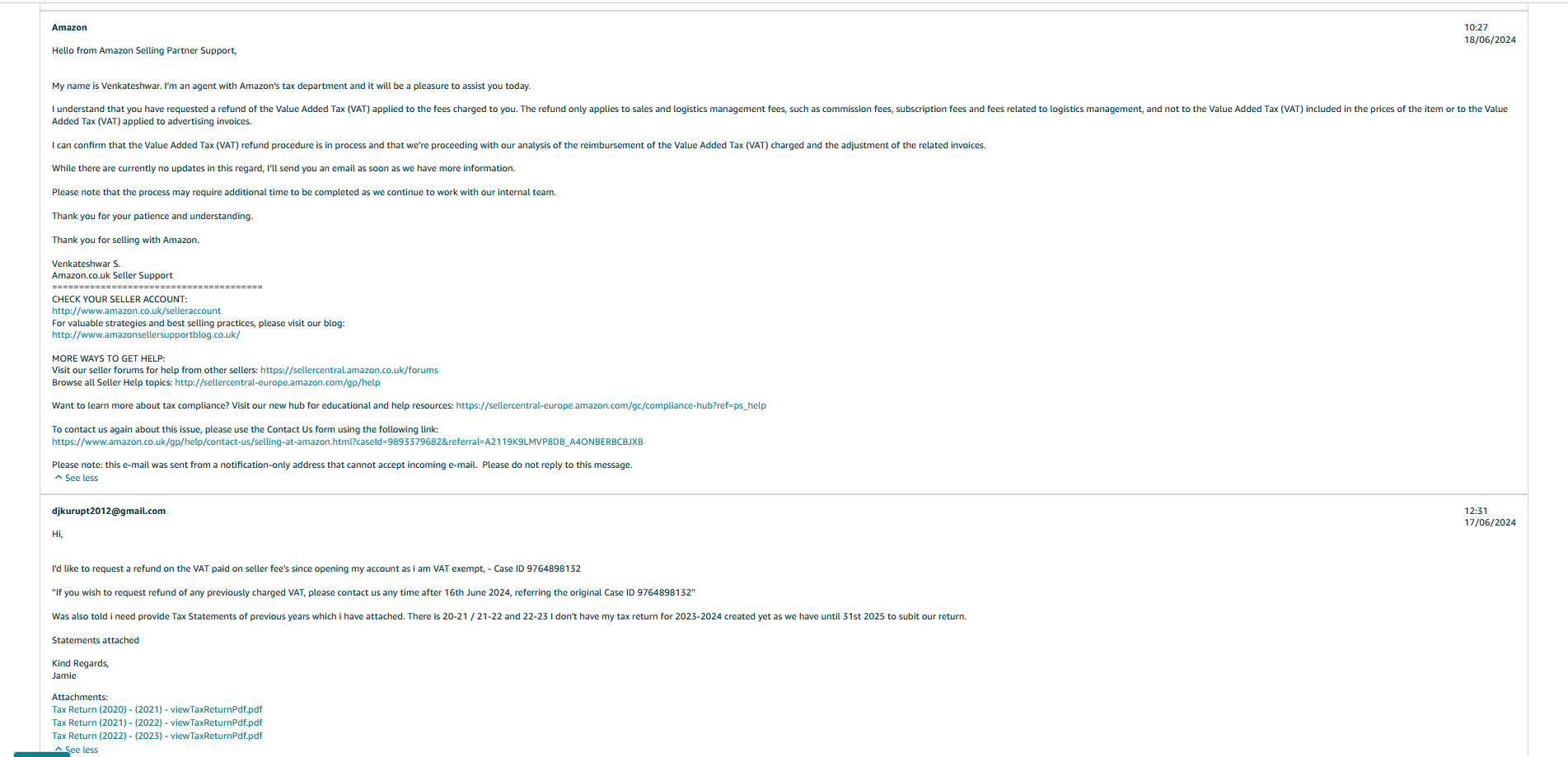

So in march i applied to be exempt from paying VAT on seller fee's as im not VAT registered and have been incorrectly charged since opening my account, that was granted and in the response from seller support i was told

''We are glad to inform you, that you have been updated in our system as VAT exempt on Merchant and FBA Seller Fees as of 7th Mai, 2024.

If you wish to request refund of any previously charged VAT, please contact us any time after 16th June 2024, referring the original Case ID 9764898132 Please also note, in order to refund you all the overpaid taxes we require the tax returns for all to be refunded years, please provide them in your new Case after the 16th June''

So i waited until the 16th of June to request my refund, opened a case and sent all my tax documents and requested the refund, this is seller supports response below. They havent given me a definitive answer saying yes my refund is being processed, im told there's no update and to be patient? It doesn't look like amazon wants to give the refund judging by this email, can anyone please advise, is this the response you recieved when you requested your refund?

Thanks

0 replies

Seller_QuM1AZgzfU9x4

It says they are working on it?

Just be aware your exemption ends in August so ensure you know your margins from then.

Seller_8jvDsRwMEdLKW

Hi, Mine all started going through about a month before yours and I have just received the payment, I got an email every 4-5 days saying they are looking into it and then ne day my payments had the VAT refund on there, I applied on May 16th for the refund as had got the same vat excemption status like yourself before that, hope this helps .

Seller_2BSBgE3FJzlK4

I contacted the managing director email, stating illegal delaying tactics as email title. got e reply within 30 minutes, almost 15k refunded within 2 weeks

Seller_GJP3Cbt07uSu0

As I believe someone has already stated this little loophole is about to be closed in August but you should get it eventually

Seller_nex6aLZ9HPynF

I am not VAT registered, never have been as fall below threshold.

Does this mean I should be contacting Amazon as I should be exempt from paying VAT on sellers fees and will be able to claim a refund.

My understanding was so many years ago they started charging sellers VAT on fees and it was tough luck if I wasn't (which reading between the lines will be the case anyway come August)

Seller_tRuvBEHDedp4q

Also just be wary that any large refund may put you over the threshold where you should have become VAT registered.

So for example you were doing a 12 month turnover of £80k and got a VAT refund back of £15k then HMRC calculate your turnover to be £95k and you would need to become VAT registered (based on current threshold of £90k)

Seller_nex6aLZ9HPynF

Compiling bits & pieces for my accountant, and try to be crystal clear with these fees.

If I add up Amazon fees from email notifications I get when an item is sold does not add up to the figures 'Sellers Fees' on the monthly PDF's

Why is this? Is it because they charge fees on postage as well which is shown on the email notification, but not the monthly 'Merchant VAT Invoice'