Help understanding EFN fee

We are a UK company, which is not VAT registered since we do not meet the threshold.

Our products are listed with Amazon FBA in the UK. Recently we had an order from Spain (which isn’t an issue), but I’m trying to understand the fees.

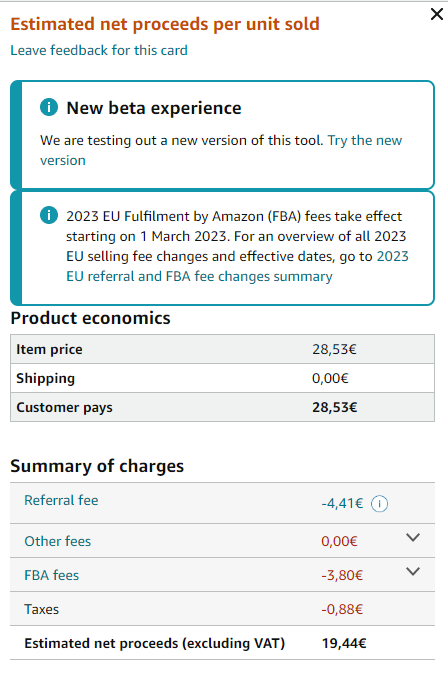

The price on the UK marketplace via FBA is £21.95. On Amazon.es, it is showing the selling price to the customer as €28,53 (which is automatically adjusted for taxes and fees). If I check the estimated fee per unit sold it shows

Now the order has been dispatched, the net proceeds are different. They show as

Product charges

€23.58

Product Tax:

€4.95

Sales Proceeds

€28.53

Marketplace Withheld Tax

MarketplaceFacilitatorVAT-Principal

-€4.95

Amazon fees

Commission:

Base amount

-€4.41

Tax

-€0.88

FBA fulfilment fee per unit:

Base amount

-€5.45

Tax

-€1.09

Change to your seller account balance

€11.75

The actual amount we received was €11.75 which converted to GBP is £10.19 (net proceeds)

For the same ASIN sold on the UK marketplace via FBA the fees are

Sales Proceeds

£21.95

Amazon fees

Commission:

Base amount

-£3.36

Tax

-£0.67

FBA fulfilment fee per unit:

Base amount

-£2.79

Tax

-£0.56

Change to your seller account balance

£14.57

I assume that I need to increase my prices by 21% (for Spain), because the Net Proceeds will not include VAT for Marketplace Facilitator order?

Furthermore, I have read that I do not need to register for VAT in these marketplaces, unless for example, I sell above the Distance-selling VAT threshold of €10,000 in Spain?

Seller_7VbclcPFFRTnc

yes amazon deduct the VAT so as you are not registered, you are automatically out of pocket and therefore you either need to raise your price, or stick to UK

2 replies

Seller_7VbclcPFFRTnc

yes amazon deduct the VAT so as you are not registered, you are automatically out of pocket and therefore you either need to raise your price, or stick to UK

Seller_EHYOwAkoZV3Hb

Amazon, being Amazon, deduct the UK vat equivalent before paying you, even for non vat-registered sellers. They shouldn’t but they do. Your selling price should be higher to cover the loss incurred by Amazon’s accounting.

What they do with it, I don’t know. Some sort of Christmas fund probably.