Sort by

Filters

Results for "토토가상계좌 @MOONPAY_CALL 1:1가상계좌 기업은행 기업은행가상 토토가상계좌"

(3148 results)Account back on after 6 appeals, looked on line watched a few videos about how to appeal, got a template on line, and boom, all accepted and back trading :-)

Hello,

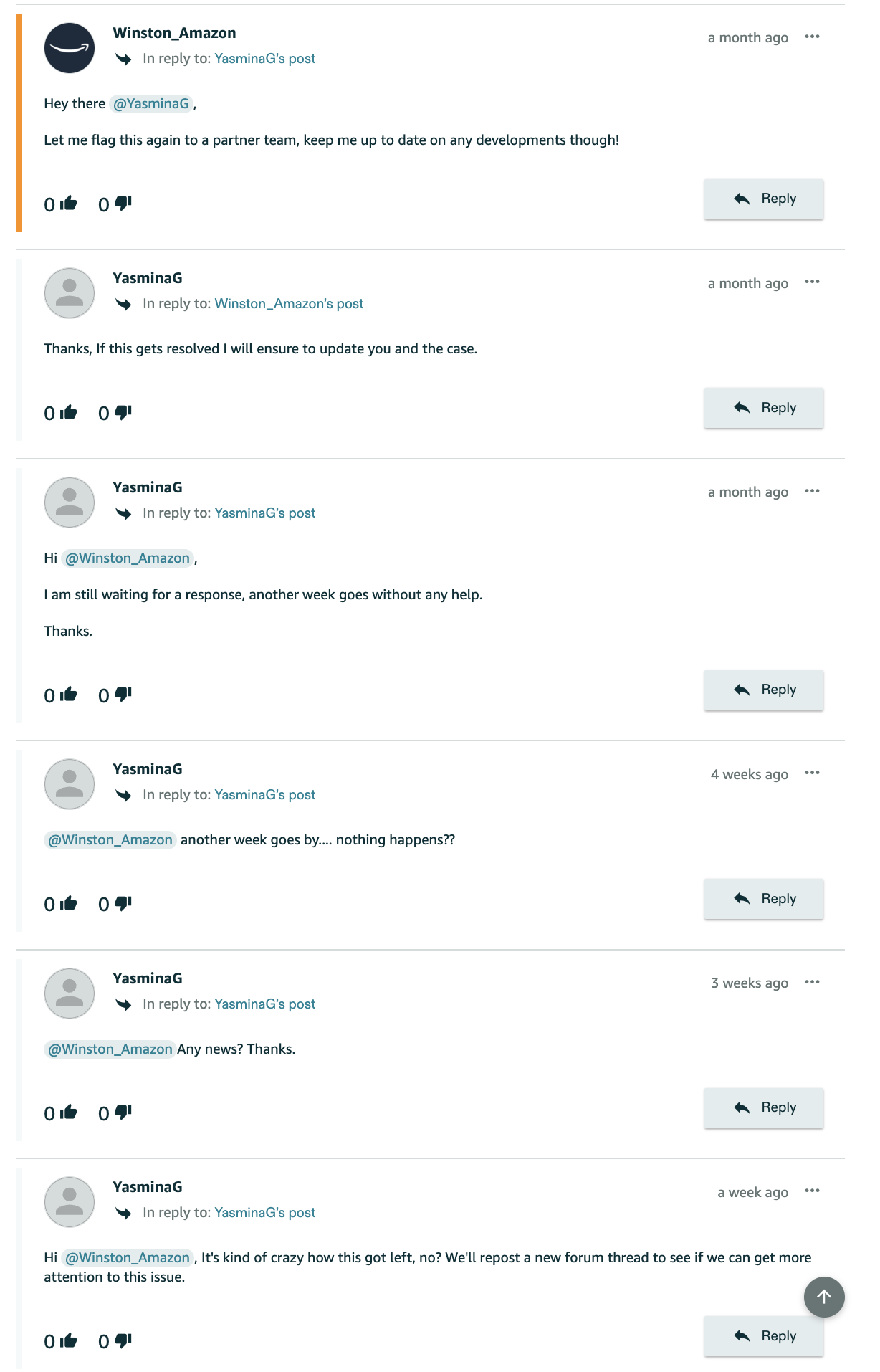

Here is my original forum post here.

It's best to read my previous post for full details, but long story short, Amazon has not resolved an issue that's been ongoing for 7 months. The moderators also seem to have abandoned my case, as it's getting no attention.

I've opened this second forum post to give Amazon another chance to resolve this before escalating further. I would appreciate it if anyone could tag any moderators to bring more attention to my case.

@Seller_TSXM2A5nxWSuH initially tried to help but went silent over a month ago. Can we please reconnect?

____

@Seller_Huz6FT08OxHAR @Seller_z3k8APxGfbQEK @Seller_DNQGSsdC7DccM @Seller_yk3kzHpjMMa4B

Attached is proof I am no longer being contacted by Amazon Forum Moderators*

Original post:

https://sellercentral.amazon.co.uk/seller-forums/discussions/t/fca3936c-3999-4869-8da9-d107e9742753?postId=0db43421-0c2d-4aec-98b0-167ba3bd21b5

Thanks so much,

Looking forward to connecting again.

__

Hi,

Our DD+7 kicked in on 19th June. Since, we've had no funds available to withdraw, having previously drawn down most days.

It says we'll have a chunk available on 3rd July at the end of the settlement period.

My question is, are we stuck having to wait until the 3rd, or will cash start to become available 7 days after the orders placed on 19th June were delivered?

The majority of our sales are FBA so those 19th orders would have been delivered on the 20th/21st, therefore I'm expecting cash to become available from the 27th.

Can anyone confirm?

Thanks,

Marc

Hello,

I really need your urgent help/advice guys.

First of all, I'm not a new seller. I've been selling since September last year, I've achieved month on month steady growth on the UK marketplace. I currently have over 700+ active SKUs.

However, overnight, without any warning or notification, since 16 June, I have had a significant issue with my Amazon account: I have lost the BuyBox/Featured Offer for ALL of my listings.

As a result, in the last few days my daily sales have dropped from around £1000 to almost zero. In addition, my "Featured Offer %" has dropped to 0%. Btw, my account health is currently 248.

I opened several tickets without success, but chatted with Amazon Support who confirmed: "As of the moment your ACCOUNT is not eligible for BuyBox".

However, as to the reason why this happened and what I needed to do to get it resolved, I was told nothing but to wait. The problem is that I am losing money every day by not being able to sell anything, but I have to cover the costs of my business and order new products.

I cannot name here a specific ASIN, because this issue affects ALL of my SKUs (700+ listings), and given that it appears to be an Amazon-side problem. Therefore I am requesting your urgent assistance.

I have already emailed the Managing Director about this, but have not yet received a reply.

Can I somehow reach the team responsible to check my account and restore the Featured Offers in my account as soon as possible?

Thank you for your prompt attention to this urgent matter.

Thank you!

Regards

I'm getting nowhere with Seller Support (Live Chat & Phone), made a ticket asking for escalation, E-Mailed CEO's office and got a pretty rude reply, I'm at a total loss as to what to do. I have lost the buy box for ALL of my key products and best sellers, I am the brand owner, I am the only offer.

I am stunned at how little support there is from Amazon, I knew it was bad but I had no idea it was THIS BAD. Absolutely no transparency what-so-ever, nothing on performance notifications, account health is perfect, no violations, I am enrolled on the new Account Health Assurance scheme (which gave me peace of mind for all of 3 days).

With the CEO's office giving me the cold shoulder, seller support sending me links to 'Seller University', spending in excess of 10 hours trying almost everything on my account blindly, I'm at a complete loss sitting here with next to no sales. So my last resort is this... a mega thread... I'm hoping with enough people complaining about the issue, Amazon MAY acknowledge this problem as a bug/glitch before I have to file for bankruptcy (no exaggeration) and when they do, I also expect no apology or compensation.

Hi, Recently received this email (EMAIL 1):

⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄ EMAIL 1 ⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄

SUBJECT: Action Required - Your disbursements are at risk of being temporarily held

Hello,

The disbursements of part or all your Amazon sales proceeds are at risk of being temporarily withheld in all stores you operate worldwide (excluding Amazon.in), because we need to confirm whether you are established in the UK for Value Added Tax (VAT) purposes. Additionally, your Fulfilment by Amazon (FBA) inventory may be temporarily blocked from removal, unless the funds withheld exceed your estimated liability.

Why did this happen?

We must collect and remit VAT from non-UK established Selling Partners for the sales of goods delivered to customers in the UK. Based on a review of your account, we determined that you may not be UK established for VAT purposes. This may have resulted in inaccurate tax treatment on your sales under the VAT on eCommerce legislation (effective 1 January 2021 in UK). We leveraged a combination of automated means and expert human review to identify this issue and make this decision. We took this action in accordance with the Amazon Business Solution Agreement: https://sellercentral-europe.amazon.com/help/hub/reference/G201190440 and Amazon Payments UK Agreement: https://sellercentral-europe.amazon.com/help/hub/reference/GTVFVCWBJ6RJGKHM.

What actions do I need to take?

To avoid further impact to your disbursements, within 30 days of this notice, go to the Account Health page in your Seller Central account https://sellercentral-europe.amazon.com/performance/dashboard and follow the instructions from the banner you will find at the top of the page. Complete there one of the steps below based on your determination of business establishment.

If you meet the criteria for UK establishment: Submit the required documentation. We will complete our review of your submission within 3 days. If we verify that your business is established in the UK, your Amazon sales proceeds will be eligible for disbursement per your disbursement schedule within 24 hours. Additionally, if your Fulfilment by Amazon (FBA) inventory was held, it will be available for removal within 48 hours.

If you do not meet the UK establishment criteria: Verify that you are not established in the UK. In this case, you will not need to provide documentation, but you will need to address any unpaid VAT.

How do I resolve my unpaid VAT?

If you do not meet the establishment criteria, you will need to pay the VAT amount to Amazon for the historical unpaid VAT on all sales from 1 July 2021, which fall under the EU VAT on eCommerce legislation. In this case, we will send you additional information regarding next steps, including payment options, within one week of receiving your confirmation.

You can continue to sell, but your Amazon sales proceeds will remain temporarily ineligible for disbursement and any FBA inventory blocked from removal from this account, and any related accounts, until we can confirm your business establishment and the UK VAT owed is paid to Amazon.

We’re here to help.

For further information, go to the “UK VOEC: Determination of Establishment" page: https://sellercentral.amazon.co.uk/gc/vat-education/voec-uk-establishment

If you have additional questions, click the 'Contact Us' button on your Account Health page: https://sellercentral-europe.amazon.com/performance/dashboard to speak to an Account Health Specialist.

Sincerely,

Amazon Services Europe

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ EMAIL 1 ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

I am registered as a Limited Company but my threshold is under the £90,000 mark for the last 12 months.

So i sent in this submission and received this response:

⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄ RESPONSE 1 ⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄

Determining your Establishment:

I do not meet the establishment criteria.

✔️ I confirm that I do not meet UK establishment criteria for VAT purposes.

After this confirmation, Amazon will review my account’s sales activity and

advise if any VAT liability is due to Amazon for past transactions.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ RESPONSE 1 ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

I then received another email (EMAIL 2)

⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄ EMAIL 2 ⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄

SUBJECT: Potentially determination of non-UK establishment

Hello,

Thank you for your submission. Based on a review of your account and the information provided, we have concluded that your business is not established in the UK for Value Added Tax (VAT) purposes.

Why did this happen?

We must collect and remit VAT from non-UK established selling partners for the sales of goods delivered to customers in the UK. Based on a review of your account, we determined that you may not be UK established for VAT purposes.

This may have resulted in inaccurate tax treatment of your sales under the VAT on eCommerce legislation (effective 1 January 2021 in UK). We leveraged a combination of automated means and expert human review to identify this issue and make this decision. We took this action in accordance with the Amazon Business Solution Agreement:

https://sellercentral-europe.amazon.com/help/hub/reference/external/G201190440

and the APUK Agreement:

https://sellercentral-europe.amazon.com/help/hub/reference/G201190400

What actions do I need to take?

You will need to pay the VAT amount to Amazon for the historical unpaid VAT for the sales of goods delivered to customers in the UK on all sales from 1 January 2021, which fall under the UK VAT on eCommerce legislation. We will send you additional information regarding next steps, including payment options.

You can continue to sell, but your Amazon sales proceeds will remain temporarily ineligible for disbursement and any FBA inventory blocked from removal from this account, and any related accounts, until any UK VAT owed is paid to Amazon. Additionally, within 10 days we will begin to collect and remit VAT taxes on your future sales for goods delivered to UK customers.

Has there been an error?

If you wish to appeal this decision, reply to this email. You may be required to provide additional information and documents during an appeal process, which we will communicate to you via email.

We’re here to help

For more information, go to the "UK VOEC: Determination of Establishment":

https://sellercentral.amazon.co.uk/gc/vat-education/voec-uk-establishment

If you have additional questions and wish to speak to an Account Health specialist, go to "Contact Us" on your Account Health page:

https://sellercentral-europe.amazon.com/performance/dashboard?ref=ah_em_ap

Amazon Services Europe

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ EMAIL 2 ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

I got 4 options which were:

1. I would like more information as to how my VAT liability was calculated.

2. I disagree with how Amazon has calculated my VAT (not exactly written like this - i cannot view this page anymore)

3. I have paid VAT to HMRC directly (not exactly written like this - i cannot view this page anymore)

4. I have not yet received any VAT liability from Amazon.

5. Other (submit info) (not exactly written like this - i cannot view this page anymore)

My response first was to select 1 and i got this response (RESPONSE 2):

⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄ RESPONSE 2 ⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄

Which of the following is your enquiry related to?

I would like more information as to how my VAT liability was calculated.

Your VAT liability was calculated by assessing the sales you made to B2C

customers in the UK since January 1, 2021 for which VAT was not previously

collected by Amazon where it is payable under e-Commerce legislation.

Please note the following:

(1) Your VAT liability only includes sales of goods shipped within the EU to

B2C customers (i.e. non-VAT registered).

(2) The VAT rates applied are determined by Amazon according to EU law.

These may differ from any product tax codes you have set in Seller Central.

vat collected and paid via amazon for my account as i do not fall under vat

registrated company in uk

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ RESPONSE 2 ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Then i had the option to pick one of the 4 again and I selected option 4. This is the response i got (response 3):

⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄ RESPONSE 3 ⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄⌄

Which of the following is your enquiry related to?

I have not yet received any VAT liability from Amazon.

✔️ Please note that it can take up to 7 days from determination of

non-establishment for Amazon to provide your preliminary VAT liability.

✔️ Confirm here that you have not yet received your VAT liability and are

waiting for Amazon to send.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ RESPONSE 3 ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Now I am waiting for a response. Is this okay?

Would this invoice I am going to receive be already be paid for as amazon has collected these fees since I have been selling?

Thank you & have a great day!

hello..!

Can someone help me out in this..

Today morning a recieved an email from amazon saying i choosed individual entity because i didn’t want to register any buisness to get involved in vat filing and all stuff,now amazon giving a warning notification in my display to change the entity for the verification of my account,its happening right after submitting bank statement for account verification,even i created my account 5 months ago,please someone come up with the solution

I turned 15 recently, I do amazon FBA Wholesale managed to get to 4k sales this month, I just have a genuine question do all the people doing Wholesale; how much do you make monthly, please specify if you are VAT exempt or not as soon for the 20% fulfilment fee to kick in I will be in a hard position, however in the past week I managed to find a new way to source suppliers soured 30 already.

Anyone who is here please drop a like because all my others got 100's of dislikes, a few G's helped me balance the dislikes and likes out.

Rate the hustle guys, going to make it! DONT SLOW DOWN!

If youve just turned 15 I assume your limited company and amazon account arent in your name?

Hi All,

I sell books and this sounds a bit invidious to me - if you put the original price for e.g. a paperback from the 1950s at £0.125 (original price) - you, or someone else could be held to an 'excessive' price of £10 for a nice copy of a paperback that's 70 years old!

If you put in your current price, you're similarly potentially limiting other sellers to a close approximation of your price regardless of condition because of "deactivated due to potential pricing error"

Looks like £0.00 is the only sensible answer...

Rock and a hard place...

Brian

- © 1999–2024, Amazon.com, Inc. or its affiliates