Sort by

Filters

Date/timeAll Time Past day Past week Past month Past 3 months Past year Date range

Tags will populate based on category selection

Results for "27와우홀덤환전업체≑[텔ㄹㅔ@𝘒𝘒8465⦌⥽블랙잭머니시세∨"

(10000 results) VTR for Royal Mail 1st/2nd class major issue

In reply to: Seller_KAWWftfFNL5CB’s post by Seller_d8YGbIjNqwFxn

Shipping small letter size orders

In reply to: Seller_QoQ4dWkKUzqCD’s post by Seller_Rvj1153dOprkQ

Shipping small letter size orders

by Seller_QoQ4dWkKUzqCD

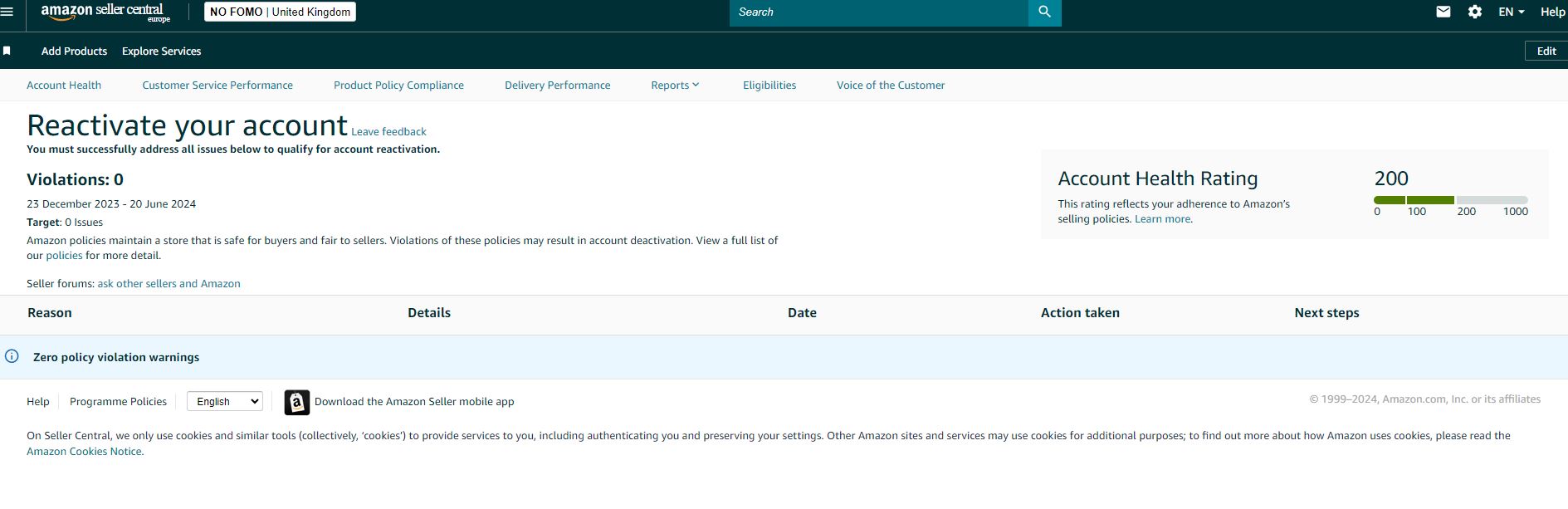

Account Reactivation - No Policy Violations to Appeal

In reply to: Seller_OEDVdWsBcOicO’s post by Seller_OEDVdWsBcOicO

Account Reactivation - No Policy Violations to Appeal

by Seller_OEDVdWsBcOicO

Need Help with VAT Establishment Verification Using a Virtual Office Address

In reply to: Seller_Sos33ZwRDBGJq’s post by Seller_LAMPSe3OczHZv

Need Help with VAT Establishment Verification Using a Virtual Office Address

by Seller_lq7Yg8ROvo8hb

Need Help with VAT Establishment Verification Using a Virtual Office Address

In reply to: Seller_lq7Yg8ROvo8hb’s post by Seller_Sos33ZwRDBGJq

Trademark transfer and listings

by Seller_NRbSrvQsLSXts

Trademark transfer and listings

In reply to: Seller_NRbSrvQsLSXts’s post by Seller_ae51e0CJoHqCX