Sort by

Filters

Results for "29윈조이코인충전▇(까똑𝒌𝒌2936}±엔포커환전상⥪"

(810 results)Hi,

@Seller_z3k8APxGfbQEK@Seller_dWnjnh5FY7ZpS@Seller_AMDYByE1754kt@Seller_yRqzR0ZXUoeEk

The issue still persists, with Amazon not recognising weekend collection and deliveries.

We have checked our Royal Mail delivery performance and they are delivering 98% next day. On our Amazon eligibilities page it says this is 94%. Given Royal Mail are responsible for this, and they are one of the only 2 approved SFP couriers, it doesn't make sense why we are affected by this? We use Tracked 24 for all our consignments.

We have 99.9% on time shipment, 98.7% buy shipping usage, 0% cancellation. All green metrics on 1,654 orders in the last 7 days.

There is nothing more we can do to satisfy requirements, and yet still are severely harmed over the weekend period when we show incorrect slow delivery times. I estimate we are losing out on around £3-4k sales revenue per weekend, not to mention dropped listings and the increased overheads we have running a Saturday shift in our warehouse.

It seems this trail is going cold, @Seller_z3k8APxGfbQEK are there no further updates at all?

Thanks

I send around 100 large letters ( £1.55 ) per month and find that 20-30% dont have delivery confirmation - so it's worth checking delivery , even if you dont get a customer complaint , because you can claim compensation for all those without confirmation ... if each item is worth £20 that's an extra £200 - £300 per month compensation from royal mail .

very rarely have non delivery for tracked 48

Hello Let me explain the whole story in a few words.

Starting on 10 April 2024

Amazon indicate to us we need to pay GBP 47,258.28 VAT starting from 2021.

You can continue to sell, but your Amazon sales proceeds will remain temporarily ineligible for disbursement from this account, and any related accounts, until any UK VAT owed is paid to Amazon.

The company behind this account was established in August 2023, so it is impossible to have VAT from 2021.

According to the notification you (AMAZON) indicated to me, you also have to pay GBP 47,258.28 VAT ... THIS THING IS NOT POSSIBLE because we have not even generated sales of this amount, so we should have so much VAT to pay, which is wrong.

The company was founded in August 2023, so it is impossible to have VAT from 2021 to pay.

Until September 2023, the Amazon account belonged to a UK-based company whose owner was a UK resident for whom Amazon collected VAT.

After many many emails with drtax-vatliabilitysupport@amazon.co.uk we send all the document requested like: id, passports, driving licence, contracts, bills, banck statments, invoice .... etc.

Since April and until now, no concrete answer, every time I send an email or open a case, the same answer is returned to me:

//////

Hello from Amazon Selling Partner Support,

My name is Guillaume and I am contacting you regarding your VAT liability request. Thank you for your patience in this case. I understand how important this is for you and I am glad to assist you the best possible way.

Please let me inform you that our internal teams are working actively on your case. There is no action required from your side and I will keep you updated about the process.

Thanks again for your patience. We remain available.

Have a nice day !

//////

Hello from Amazon Selling Partner Support,

We understand how important is this matter for you. In response to your inquiry regarding the VAT applied to your invoices, we would like to inform you of the following:

The corresponding department is still working on your case and we will get back to you as soon as we have further information to provide.

We appreciate your patience and it was a pleasure to assist you.

Thank you for selling with Amazon.

///////////

on 19 June:

Hello from Amazon Selling Partner Support,

Thank you for your patience. At the moment, I am working with our internal team to reach a resolution on your case. While I don’t currently have an update, I will follow up with you as soon as additional information is available.

Thank you for selling with Amazon.

Sara B.

//////

3 months have already passed and nothing.

Does anyone know how soon the verification will be completed?

Can anyone help me speed up the verification process?

Very bad impact on store sales near to zero for 3 months.

Thank you

any help is highly appreciated @Seller_DNQGSsdC7DccM @Seller_gAhPNiLrkfTcr @Seller_yk3kzHpjMMa4B @Seller_VJ4XoAkjDpjPH @Seller_Huz6FT08OxHAR @Seller_fgtTzyHQfOM1x @Seller_TSXM2A5nxWSuH

Total waste of time reporting anything like this to seller support. We gave up doing that years ago. Most issues require 20+ responses, weeks to resolve, constant auto replies, nobody taking ownership of the problem, and then we are usually told that nothing can be done for any number of reasons.

When this happens we just sell through eBay instead.

Amazon are losing thousands in fees from us because of the huge volume of products that we cannot sell on Amazon because of issues like this - I am talking thousands of products which cannot be added.

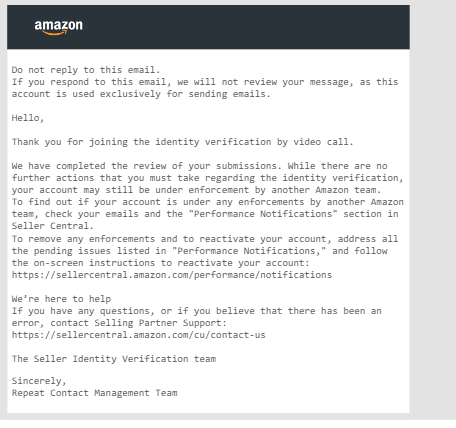

Hello. our account was deactivated on 11 april 2024 and funds were hold. upon enquiry with multiple teams on emails, we waited for 60 days. now today on 21 june 2024 we had our interview call done for identity verification. we received email after the interview as mentioned below. i would like to know when the funds will be released as the person only verified my passport and ask few basic questions only. it went smooth. and what enforced team they talking about? as my account deactivated due to recent VAT issue. i will resolve it with the team once the funds will be released as per amazon withhold policy.

@Seller_z3k8APxGfbQEK@Seller_hnDMgUKxMh1V4@Seller_Huz6FT08OxHAR@Seller_yk3kzHpjMMa4B your help will be appreciated if you could get this sorted asap and get my funds released please.

Just need look at your margin & not worry about what other sellers are doing.For me,25% is minimum I know many sellers run at a margin way lower there's lots of busy fools on here. I currently average 35-40% daily/monthly.If any sku drops below 25% I just dump it & move on

it depends on the product, if I have a product that sells relatively well, have few or no returns, doesn't require much packaging, I am happy with 15%/20%. I agree with you, it's important to focus on the bottom line, what other sellers do or how much you sell is not important. I am up 67% from last June and yet I sell less products.

Seller_soBD2wwhsVOww

Hi,

I have an ongoing issue with Amazon & Royal mail, this is the third time this has happened now.

I send an item via Royal Mail special delivery, parcel gets delayed, customer complains, Amazon refund order in full. Item then gets delivered to the customer who has been refunded, customer of course ignores any correspondence i send, i attempt to claim via Royal Mail but they deny my claim & state they have 8 days to deliver a Special Delivery parcel... despite it being a 24 hour service.

I cannot seem to win. I wouldn't mind so much but these are mobile phones costing up to £1000. It's just totally unacceptable and I'm getting sick to the back teeth of continuously losing large sums of money due to incompetence and flawed systems.

I alternate between Royal Mail & DPD, however DPD have rejected every claim of mine despite them losing numerous parcels. These huge companies are despicable and i can't think of any way around this issue. Has anybody got ANY advice?

Hello,

I find it extremely concerning that if as a seller, I'm not meeting the target rate of below 5% for uploading an invoice within 24 hours of a customer payment, I am at risk of deactivation.

If this is such a sensitive metric that can lead to de-activation of an account, why isn't there a notification alert from Amazon requesting sellers to upload the invoice within 24 hours of the payment being made with the order I.D for said invoice each time? We get an email alert to respond to buyers messages within 24 hours of the buyer message for instance.

As sellers, we have a host of duties to perform. Do they expect us to check the orders page every few hours to ensure this mundane task is promptly met within a very narrow timeframe each time? This is extremely unreasonable in my humble opinion. I would like to adhere to this, however, life gets in the way, and without notification prompts, this is very difficult to adhere to ALL OF THE TIME.

Is there a way to receive an alert from Amazon each time an order is placed requiring an invoice to be uploaded?

I have auto invoices set up for all the countries where I have VAT registration, but occasionally, you get orders from other EU countries that do not have VAT registration, thus making this task difficult to adhere to without fail.

How amazon destroyed my business.

At the beginning of the year I received a verification letter like many others. Initially I successfully passed their verification, a few hours later I received a second email that my account would not be opened because I was not VAT Establishement. They decided I am not a VAT establishment, even though according to UK state I am! I have emails for everything.

On the 17th of May I received a message from Amazon that I am VAT establishment, after sending them the official HMRC statement, and an official letter from my bank, which they wanted.

A few hours after that I got an email saying I had a policy violation from 22 March, and that my account would remain closed. The ridiculous thing about this violation is that I am not VAT establishment : screenshot 2

It appears that they are closing my account, for a violation according to them, which they then themselves find is not a violation ?!

Meanwhile, in April they forced me with a 7 day deadline to accept their payment plan to HMRC. According to them and HMRC I am VAT establishment but they have already started pulling the first instalment for this plan as if I am NETP ?! Over £6300!

And that's not all! Of my £35000 (over 6300 they took it for vat?!) that was blocked, 40% of that money is a credit to Amazon. The terms of the credit said that if they couldn't pull it from a bank account, they would pull it from the Amazon account. They haven't pulled them for five months now! But they charge me over 20% APY on over 15000 pounds. So every month or so they charge £250 per. month interest on money they have blocked from me and not withdrawn!

Amazon does whatever it wants with impunity. It violates all contracts, policies, steals other people's money. Even when I dropped them official letters from HMRC, they refused to accept them the first few times. Why does a corporation think it is more than the state ? So like all my listings I was selling I was competing directly with Amazon. Is Amazon pursuing a deliberate policy against the destruction of small sellers through various methods and loopholes they have found ?

- © 1999–2024, Amazon.com, Inc. or its affiliates