Sort by

Filters

Results for "49바카라현금화⋭⸤텔레ᴋᴋ8465> ➱피망머니 파는곳⬌"

(408 results)

Hi,

I have received an email that is either genuine or a very good fake, with the title "Email - Action Required: Amazon seller account review". It wants me to click on a link and answer some questions to arrange a virtual video call to confirm my identity, which I am happy to do, but I would like to confirm that the email is genuine before I input my merchant token etc.

I can't see anything within my seller account to indicate that this email has been sent, and the email also says that "Your Amazon selling account has been deactivated ", but there is no indication of this either, which makes me think the email may be a good scam.

Whenever I have used seller chat (for other issues), the replies that I get have been unhelpful and inaccurate (to be polite), and I see that the help that people get is on here is great, so that is why I am asking here first. Could an Amazon mod please take a look at my account and let me know if this email is genuine?

Also, if any Amazon sellers think that the email sounds genuine, do you know how long I might have before my account is actually deactivated?

Thank you very much

@Seller_VJ4XoAkjDpjPH @Seller_fgtTzyHQfOM1x @Seller_mIRnuhdx7l5sN @Seller_pcsb5w54JugEA @Seller_iTgjdgiRqiPsn @Seller_Huz6FT08OxHAR @Seller_TSXM2A5nxWSuH

Full email below FYI:

Dear Seller,

selling account has been deactivated in accordance with Section 3 of the Business Solutions Agreement. Amazon’s Business Solutions Agreement can be found here.

Why is this happening?

We have reviewed your account and would like to confirm your identity.

How do I verify my identity?

To verify your identity, you need to complete virtual identity verification over a video interview. To reserve a time slot for the interview, fill out the form here.

After we receive your response on this form, we will invite you for the interview on one of your preferred time slots, 48 hours before the interview. After your verification interview is complete, we will review the results and respond with the outcome within 5 business days.

We’re here to help.

If you have any questions, contact Selling Partner Support.

Hi

Looking for some help from moderators please?

Our base reserve policy is due to come into place 19 June, we had an email that said we could apply for an extensions.

It requested we email eu-uk-reserve-policy-extension@amazon.co.uk

We have emailed requesting an extension due to the extra cash flow problem the news about VAT on fees will cause. Should I have included our merchant token?

I have emailed twice now and got now reply -

How do I know that they have the email, what timescale should I be waiting on?

Any advise

It is business critical so even a no would be better than a no reply if you see what I mean!

Dear @Seller_Huz6FT08OxHAR,

Yesterday we received another reply in CASE ID: 9844266592, to send again all our company's documents to the Spanish email address: kyc-drtax-verification@amazon.es

Which we did yesterday as well. Today, we received a performance notification stating that it would take up to 15 business days. We are already over 5 weeks that Amazon is trying to evaluate the obvious: : that we are talking here about the EU establishment, and NOT about the UK!

Our EU company has NEVER had any selling activities in the UK, has no inventory in the UK, and has never used Amazon FBA in the UK, which Amazon can easily verify in our seller account.

AND, finally, we have a written confirmation from Amazon on Case ID: 8743895752 on 19/05/2023 stating the following:

"I would like to inform you that if you change your legal entity to an address in Cyprus on Seller Central and that legal entity is verified and your listings are stored in the EU and you send your listing to a EU country, Amazon will not collect and remit VAT"

Can you please contact the relevant Amazon team to finally get to the bottom of this as you are literally killing our business because of Amazon's incapability to understand the EU/UK eCommerce Legislation for VAT establishment?

Let us hear from you soon!

Thank you very much

Hello @Seller_cKY3qrMo5t89S,

Your inventory should be available for the customers as per Reserved Inventory report help page:

"Units in the FC transfer status are available for customers to buy. However, customers might be shown a future ship date if no other units are available in the fulfilment centres for immediate fulfilment."

Additionally, here I am including the information that I found on how long this process can take:

"Transfers may take up to 22 to 25 days to complete. In some cases, transfers may take longer and investigation may be required (for example, delays due to Covid-19 restrictions or weather restrictions)."

Regards,

Sakura

Hi, I am letting people know that Amazon have changed their policy on Royal mail 2D Bar codes i.e Royal Mail scanned on delivery. Sometime ago I raised this with Amazon that all our packages have "valid tracking" but Royal mail only scan about 80% and was told not to worry as Amazon are aware and will disregard if when needed we provide valid tracking proof. ie we sent them copies of the delivery label. Well that has changed. Last Friday some listings were deactivated and I had to provide the appeal which I did as usual, but this time it was turned down After a long conversation the result was we either change to a different post method (which would add about £1.00 to the cost and on cheap items that is a big percentage) or buy the same service from Amazon!

I am uncertain what the motive behind this is, to be competitive we will need to buy postage from Amazon? What I tried to explain is that as far as the customer is concerned there will be no improvement Royal mail will continue to fail scanning packages. In addition as we use 3rd party software to process all orders, will it be more difficult? Will Amazon then get details of my orders from Ebay and our own website? I think this stinks and anyone using Royal Mail 24 / 48 (CRL) should take note. Short term we will change to Royal Mail Tracked and accept less orders, longer terms we may have to buy shipping from Amazon, but before we do we need to consider the pros and cons

@Seller_yk3kzHpjMMa4B@Seller_XUNeUuvrQDpgP@Seller_Huz6FT08OxHAR @Seller_hnDMgUKxMh1V4 @Seller_DNQGSsdC7DccM@Seller_z3k8APxGfbQEK @Seller_TSXM2A5nxWSuH@Seller_fgtTzyHQfOM1x

Guys please look into my issue its been more than 45 days now.

I am not established in the UK for VAT purposes and need to pay unpaid VAT owed to amazon.

I was told to contact mdri-exec-escalations@amazon.co.uk on May 13th, 2024. According to the information I received from the Amazon notification they had to answer in 48 hours time. This time have passed long time 3 days ago but they still does not respond.

We had received an email on May 9th, 2024, the email stated that "You can continue to sell, but your Amazon sales proceeds will remain temporarily ineligible for disbursement and any FBA inventory blocked from removal from this account, and any related accounts, until any EU VAT owed is paid to Amazon. Additionally, within 10 days we will begin to collect and remit VAT taxes on your future sales for goods delivered to EU customers."

We have two questions regarding to our unpaid VAT.

1) Where can we find our amount or balance for our unpaid VAT?

2) Where can we pay for our unpaid VAT?

Also, we haven't received our VAT liability from Amazon and no other information from Performance Notifications.

We only have 3 more days left until the deadline, and we don't want to get any penalty from government.

Please advise us and guide u

Can anyone advise?

My product size: 249*21*18cm, weight: 19kg

It belongs to heavy and bulky goods

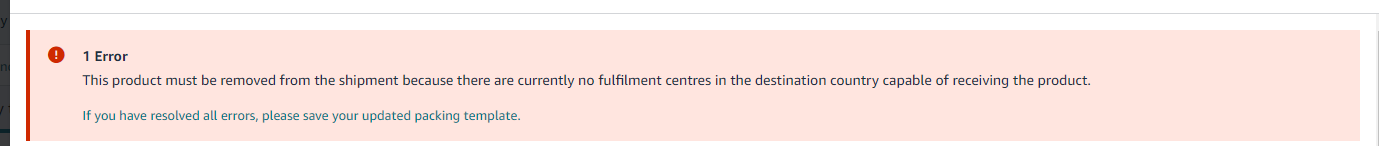

I was able to create shipment plans normally before, but now the system reports an error: This product must be removed from the shipment because there are currently no fulfilment centres in the destination country capable of receiving the product.

What is the reason for this, I contacted the seller support team has been half a month, has not been resolved.

A customer purchased a Ministry Of Sound CD but was disappointed with the DJ party style track mastering. She therefore left a negative feedback rather than a product review. I contacted the customer and offered her an alternative product which she loved. She then tried to remove the original negative feedback but has been completely unable to achieve it despite her spending over an hour on the phone to Amazon buyer customer support. She has also sent me a number of Amazon buyer-seller messages to say she wants to remove the feedback but needs help because she is not up with the technology.

After all of her efforts with buyer customer support, the result was an Amazon message sent by buyer support to me to say that I should remove the feedback? (See below)

"...Dear Amazon Seller, This is Amazon’s Customer Service team. A customer reached out to us with some questions about a purchase they made from you. Here’s a description of the issue:

Product: B0714H5FZH Order number: 205-6165475-6531550 Return requested: No

Reason for contact: cx wants the feedback to be removed , please get this done as soon as possible Please respond to this request within 48 hours. Thanks, Amazon Customer Service..."

I got in touch with Amazon Seller support and they contacted the feedback team but the answer coming back was that yes they can see that the buyer is trying to remove the feedback and has technical difficulties but unfortunately there is "nothing they can do".

Lets face it, the software options are difficult to handle, finding where to remove feedback is not easy to find even when you are experienced and the process of contacting support is being made ever more awkward.

This has been an unbelievable and disappointing experience for both buyer and seller surely Amazon can handle these situations better ?

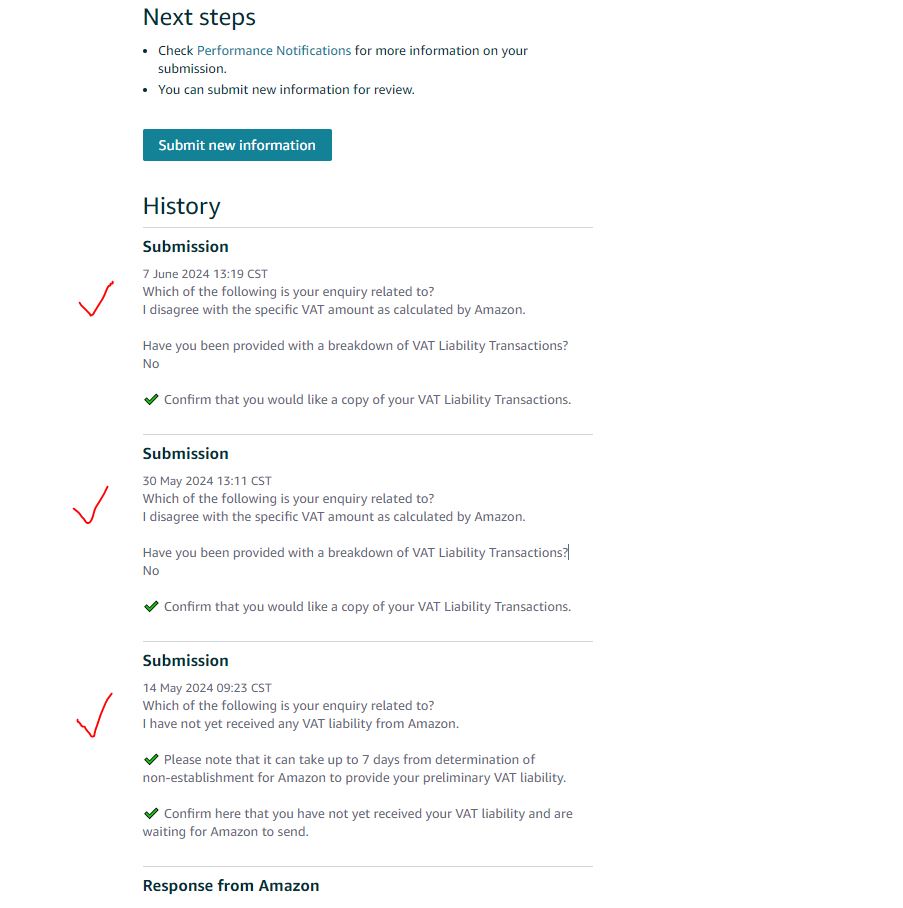

Hi Amazon,

We are extremely frustrated. Since we requested Amazon to provide us with the VAT breakdown for 14 May 2024 09:23 CST, 30 May 2024 13:11 CST, and 7 June 2024 13:19 CST, after almost two months, Amazon did not provide us with the information for our GBP 265,818.93.

Is it that hard? Our account payment has been frozen for two months, and Amazon did not want to help us, neither were from willing to pay back the VAT owed to Amazon (Forums) and mdri-exec-escalations@amazon.co.uk keeps responding to us that we still need to wait for 72 hours. We have received three similar emails stating that we need to wait for 72 hours on June 6, June 18, and June 19.

Can we get any help from Amazon, or can others assist us in deactivating our Amazon account?

Please do help us.

- © 1999–2024, Amazon.com, Inc. or its affiliates