Results for "서든어택핵 (스카이몰.NET) 월핵서든, 서든어택핵쿠팡, 옵치핵제작, 서든핵사이트, 서든랭커용핵, 옵치핵구매사이트, 서든랭커핵"

(21 results)Seller_HmXs9Pk97Wcpt

∙Seller_HmXs9Pk97Wcpt

∙Seller_uPuf4V7GDz2aH

∙repliedSeller_fj3M54GkuGQyT

∙repliedSeller_40ozsHlGqPuEL

∙repliedSeller_NpMpf7WPoaL9g

∙repliedSeller_ClXXrSNsyNxyN

∙repliedSeller_ClXXrSNsyNxyN

∙repliedSeller_MT8rt0A2OpbCx

∙repliedSeller_Huz6FT08OxHAR

∙repliedSort by

Filters

Date/timeAll Time Past day Past week Past month Past 3 months Past year Date range

Tags will populate based on category selection

Results for "서든어택핵 (스카이몰.NET) 월핵서든, 서든어택핵쿠팡, 옵치핵제작, 서든핵사이트, 서든랭커용핵, 옵치핵구매사이트, 서든랭커핵"

(21 results)Seller_HmXs9Pk97Wcpt

∙Can Someone Help me Understand Amazon's Reports Repository

by Seller_HmXs9Pk97Wcpt

Latest activity

Seller_HmXs9Pk97Wcpt

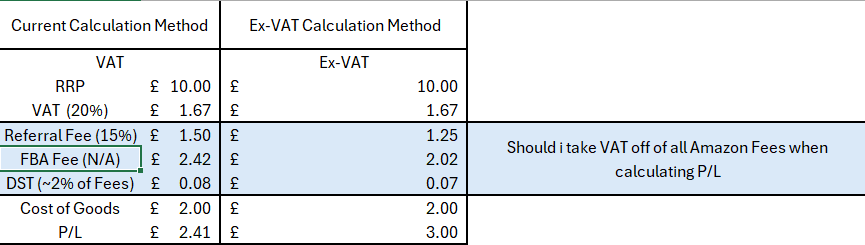

∙Profit Calculation Method Question

by Seller_HmXs9Pk97Wcpt

Latest activity

Seller_uPuf4V7GDz2aH

∙repliedBoxes flagged by FC for having straps & metal staples

by Seller_uPuf4V7GDz2aH

Latest activity

Seller_fj3M54GkuGQyT

∙repliedFarewell fellow sufferers, and a two fingered salute to Bezos.

by Seller_fj3M54GkuGQyT

Latest activity

Seller_40ozsHlGqPuEL

∙repliedNew term financing option available for eligible UK sellers

by Seller_40ozsHlGqPuEL

Latest activity

Seller_NpMpf7WPoaL9g

∙repliedUK advice: How do you deal with cash flow? I feel like my business cannot grow because of slow payouts

by Seller_NpMpf7WPoaL9g

Latest activity

Seller_ClXXrSNsyNxyN

∙repliedI am being charged VAT - Seller support says tough luck

by Seller_ClXXrSNsyNxyN

Latest activity

Seller_ClXXrSNsyNxyN

∙repliedI am being charged VAT - Seller support says tough luck

by Seller_ClXXrSNsyNxyN

Latest activity

Seller_MT8rt0A2OpbCx

∙repliedUK advice: How do you deal with cash flow? I feel like my business cannot grow because of slow payouts

by Seller_MT8rt0A2OpbCx

Latest activity

Seller_Huz6FT08OxHAR

∙replied[CLOSED] Get answers about Transparency at an Ask Amazon event today, March 19th!

by Seller_Huz6FT08OxHAR

Latest activity