Countries

Read onlySeller_wK6nUuxgJ5ATw

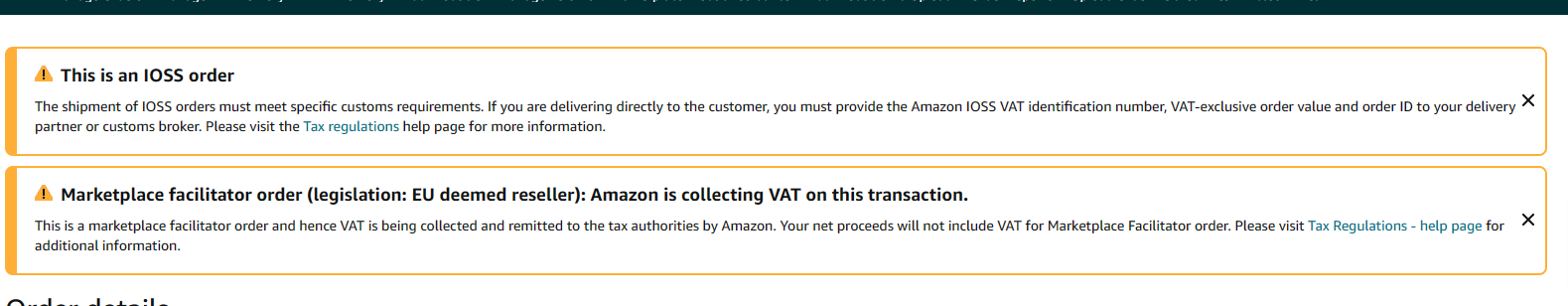

UK Seller on Amazon Turkey - Is Amazon is collecting VAT

Tags:Taxes

00

0 replies

Seller_Vf10jieAEG9f1

Marketplace facilitator does not apply in Turkey. If you are selling MFN then you will need to send goods via a tax paid (DDP) service.

10

Follow this discussion to be notified of new activity

Similar Discussions

Seller_9xK94IXvWAuDx

∙Seller_TxLIAKHXv9ZdV

∙Seller_ntgOBhcfvsi3y

∙